Knowing how to set up an estate plan can seem confusing. Use this guide to cut through the legal complexity.

What Is Estate Planning and How Do I Start?

Snapshot

An estate plan involves a will or a trust and tells your loved ones what you want done with your things. It can also help minimize estate taxes. If you don’t have an estate plan, a court will decide what’s done. And while your death will soften the blow, the court’s findings still might leave you feeling cold. So you should have an estate plan if you’re 18 or older.

Estate planning is just a fancy legal-ish term for what you want to happen to your money and your stuff if you die or become disabled.

Your will is a big part of estate planning. But there’s a whole lot more to think about, like figuring out what type of will you need or if you need a trust. Plus, you need to decide which people you want to handle your estate, get your stuff, and take care of your kids and pets. Not to mention, you need powers of attorney to make medical and financial decisions for you (in case you lose the ability).

Yeah, it can seem complicated, but that’s why we created this guide. It’ll give you all the estate planning essentials and break down the big stuff so you can start planning with confidence.

Why Do I Need an Estate Plan?

Having a solid estate plan in place is a big deal. Why? Because if you die without a will (or a complete estate plan), the court gets to make decisions for you. That can include putting someone in charge of handling your estate, deciding who gets your stuff, and picking caregivers for your children or pets. Don’t you want to have full control over those decisions? We knew you did!

Taking the time to put your plan together also shows you care enough about your loved ones to provide for them even after you’re gone. And it can be a good way to minimize estate taxes. Plus, it gives you a legacy you can be proud of and peace of mind knowing the wealth you’ve worked so hard to build ends up exactly where you want it to.

In the video below, our friends from RamseyTrusted® provider Mama Bear Legal Forms will walk you through why estate planning is so important.

What Are Estate Taxes and How to Minimize Them?

If you have a high net worth, estate planning helps minimize the taxes your loved ones will have to pay out of your estate when you die. Most people won’t have to worry about federal estate taxes, but if hiring Adele to play at your son’s wedding and taking regular trips to your second home in Fiji sound normal to you, you’ll probably need to pay attention to federal estate taxes (aka federal death tax). For the rest of us, though, state estate taxes are more likely to be a concern.

While the federal estate tax threshold (how much your estate has to be worth to get taxed) is $13.99 million, certain states also have estate taxes with much lower thresholds. For example, Massachusetts’ estate tax threshold is $2 million and Oregon’s is even lower at $1 million.

The good news is, there are ways to reduce your estate taxes, and they include:

- Using a trust: Putting your assets into an irrevocable trust—which takes them out of your taxable estate—is just one way to use trusts in your estate planning tax strategy.

- Charitable giving: Bequests (gifts in your will or trust) to charities aren’t taxable and reduce your estate value.

- Gifting while you’re still alive: Giving away as much as you can while you’re living is a great way to reduce your taxable estate and still give it to the people you love. Just make sure to keep your gifts below both the annual and lifetime gift tax thresholds.

If your estate is big enough that you’re looking at ways to avoid estate taxes, it’s a good idea to consult professionals like an estate planning lawyer and accountant.

What’s in an Estate Plan?

Here’s a high-level view of what documents a complete estate plan will include:

- A will or trust (or both)

- A financial power of attorney

- A health care power of attorney

Additional documents you should include:

- A letter of instruction

- A living will

Let the experts from RamseyTrusted® provider Mama Bear Legal Forms break down some estate planning basics.

When Should I Start Estate Planning?

Retirement and estate planning feel like they go hand in hand, but actually, if you’re 18 or older, you need an estate plan. Today. But it doesn’t have to be complicated. It can be as simple as taking a few minutes to create a will online and letting your loved ones know you’ve got one in place. That means no more excuses!

Download the Estate Planning Checklist

If you’re ready to start knocking out the steps of your estate plan, here’s a checklist to help you stay on track.

What Are My Options?

When you’re creating an estate plan, your options are:

- A will

- A trust

- Sometimes both

Will an online will work for you?

Find out if an online will works for you in less than 5 minutes.

Will vs. Trust

Snapshot

Both wills and trusts are tools that list instructions for what should be done with your assets when you die. The main deciding factor between wills and trusts is the size and complexity of your estate. For most people with a net worth under $1 million, a simple will is enough. Wills pretty much always go through probate, but a trust, if you set it up right, can help you avoid probate.

Wills and trusts are both valid legal documents that list instructions for what you want done with your stuff. Deciding between the two really comes down to what works best for you and your loved ones, which will be influenced by the size of your estate and complexity of your family situation. The most common of each are simple wills and living revocable trusts. Don’t worry—when it comes to deciding between a simple will or a living revocable trust, you can’t really make a truly wrong decision.

So, who needs a will vs. a trust? Well, if you’ve got a few kids and a house, you only need a will (which you can create online with attorney designed documents). And you don’t need to meet with a lawyer unless there’s something complicated about your situation. On the flip side, you’re more likely to need a trust (and only a trust) if you’re older, your kids are grown and your estate is worth at least $1 million. This lets you avoid probate in a way that most wills won’t allow.

Figure out whether your estate hits the $1 million threshold with our net worth calculator.

If you have dependents plus an estate that’s large or complex, you need a will and a living trust. (Your will fills in the guardianship gap of a trust.) And don’t worry—they won’t bump into each other. They’re separate legal tools, and they don’t usually have conflicts between them (unlike siblings). If there’s a legitimate conflict, the trust overrides the will. Keep this in mind: Most people need a will, but much fewer need a trust. The main unique power of a will is the option to name a guardian for your children, while the main unique power of a trust is to skip probate.

Here’s a little more nuance on the situation from the experts at RamseyTrusted® provider Mama Bear Legal Forms.

Last Will and Testament

Snapshot

A will is a legal document and the simplest way to explain what you want to happen with your stuff and kids when you die. With a will, your estate will almost always go through probate, but it will make things smoother and faster. There are a few different kinds of wills, but a simple will is the most common and can be purchased online (cheapest option) or through lawyers.

A will is a legal document that puts in writing what you want to happen when you die. It outlines things like who you want to get your money and your stuff—and who should look after your kids and pets. There are several types of wills, but they all boil down to the same basic document. A will can resolve issues as big as dividing the family farm among five siblings or something as small as making sure your nephew gets the pocketknife he admires.

Having a will makes the probate process easier and quicker, saving your loved ones time and money in court fees. Understanding the different types of wills doesn’t have to be confusing. We’ll break them down so you can make a smart choice and create a will that’s right for you.

Types of Wills

Simple Wills

A simple will covers the basics—without any fancy clauses or stipulations. Despite its name, you can do a lot with a simple will. You can declare how you want your stuff given away and who gets it.

You can also name a guardian for your kids and choose the person (called a personal representative or executor) who makes sure your will gets carried out. You can even name the person you want to care for your favorite ferret. In other words, a simple will can cover a lot of ground.

Living Wills

Even though the names are similar, a living will is not a last will and testament. A living will is a document that explains your wishes for your end-of-life medical care if you can’t speak for yourself. (Unfortunately, it happens. And a living will makes your wishes clear.)

This type of will lets you maintain control of your life and future even if you’re seriously injured or become terminally ill. Every state handles living wills differently, so make sure yours is done to match your state’s requirements.

Joint Wills

A joint will is a document created by two people who want to leave their stuff to each other. (Think husband and wife.) It’s just a single document that two people sign. In it, the couple agrees that when one spouse dies, the other inherits the whole estate. Pretty logical, right?

When the surviving spouse dies, their stuff goes to someone the couple named together. A mutual will does the same thing, only it involves two wills that both spouses sign.

But keep in mind—joint wills can turn into a legal headache. A better option is a mirror will.

Mirror Wills

A mirror will includes two wills that are drafted almost identically, but they have different testators (aka people who make the will) and are signed individually.

Often, mirror wills state that the surviving spouse inherits the estate and cares for the kids, but other details may be different between the two. Because mirror wills are actually two different wills, part of the estate can go to someone besides the surviving spouse. So you can leave the antique family brooch to your sister or cousin and leave the rest of your stuff to your spouse.

The other advantage of a mirror will is that each spouse can make changes to their will whenever they need to without their spouse’s signature. This can prevent some serious issues, particularly after one spouse dies.

Holographic Wills

Nope, a holographic will wasn’t invented at a sci-fi convention. It’s a last will and testament that’s written and signed by hand. Believe it or not, these wills are still around. People in life-threatening situations (a soldier in a combat zone, for example) may write one if they think they might not survive.

Not all states see holographic wills as valid, so if you have one, make sure your state will accept it. With today’s technology, it’s a whole lot easier to create a will online and save your family the possible heartache and frustration of an invalid will.

Nuncupative Wills

This is way simpler than the name makes it sound. It’s a last will and testament that’s spoken out loud instead of written down. This kind of will is made when the person making the will may die soon.

Nuncupative wills have rules that differ from state to state. In some states, the person voicing their wishes has to be dying, and it may only be valid if three or more people witness the person speaking. Sometimes, the nuncupative will has to be written down after being spoken, and other states won’t recognize a spoken will at all.

Deathbed Wills

A deathbed will is exactly what it sounds like: You create it if you’re facing certain death. You can write and sign it by hand, or you can type it out and sign it in the presence of witnesses. It’s a lot like holographic or nuncupative wills. The only real difference is that deathbed wills are typed.

Now here’s the thing about deathbed wills: They’re almost always written at times of extreme stress for everyone involved. No matter how you create one, this kind of will can cause all sorts of problems. They’re often filled with errors because they’re written so quickly. And it’s harder to prove them as valid. This is why it’s so important to create an estate plan ahead of time (and you’re doing that, so good on you!).

Want more info about the types of wills? Check out this article.

What Happens if I Don't Have a Will?

If you don’t make a plan for what happens to your belongings and beneficiaries when you die, the state will. Learn how you can take control of your legacy from Mama Bear Legal Forms, our RamseyTrustedÆ wills provider.

Ready To Get

Your Will In Place?

Complete Last Will & Testament Package for Married Couples

$249

2 - Last Will & Testaments

2 - Health Care Powers of Attorney

2 - Financial Powers of Attorney

Mama Bear's Promise: If our product doesn’t meet your expectations—we’ll refund your money. (No hard feelings.)

Complete Last Will & Testament Package for One Person

$159

Last Will & Testament

Health Care Power of Attorney

Financial Power of Attorney

Mama Bear's Promise: If our product doesn’t meet your expectations—we’ll refund your money. (No hard feelings.)

State-Specific Requirements

Each state has different rules about how to handle a person’s passing. If your will doesn’t meet state-specific requirements, your personal representative might have trouble carrying out your wishes. And that means your family could find themselves tied up in the probate process while the court decides how to fill in the gaps. It's much easier for your family if you go ahead and use a state-specific template or make your will within the legal requirements of your state.

Want a preview?

Select your state in the box below to see a sample will created by our RamseyTrusted provider, Mama Bear Legal Forms.

Download the Free Last Will and Testament Worksheet

If you decided that a will is right for you but aren’t sure where to begin—don’t stress! Snag a copy of our Last Will and Testament Worksheet. It’ll give you the head start you need to make creating your will a breeze.

Trust

Snapshot

Trusts are more complex and expensive to set up than wills and are a good choice for large or complicated estates. The most common type of trust is a living revocable trust, which is a trust that is made during your lifetime and is changeable. One big advantage of trusts is that they can help avoid probate.

Like a last will and testament—a trust is a written legal document. But unlike a will, it can go into action while you’re still alive. When a trust is formed, the person who owns the stuff (the grantor) transfers the ownership of their assets to the trust itself. The grantor then picks someone (a trustee) to carry out the instructions in the trust.

Some of the advantages include skipping probate court, estate planning privacy (estates become public record when they go through probate court), and the ability to make conditions for who gets what. Remember though—a trust can’t name a guardian for your children. Only a will can do that.

So, who needs a trust instead of a will? People with large or complicated estates (or family situations).

Trusts come in lots of different forms—close to a dozen, in fact. We’ll cover the most common types in the following section.

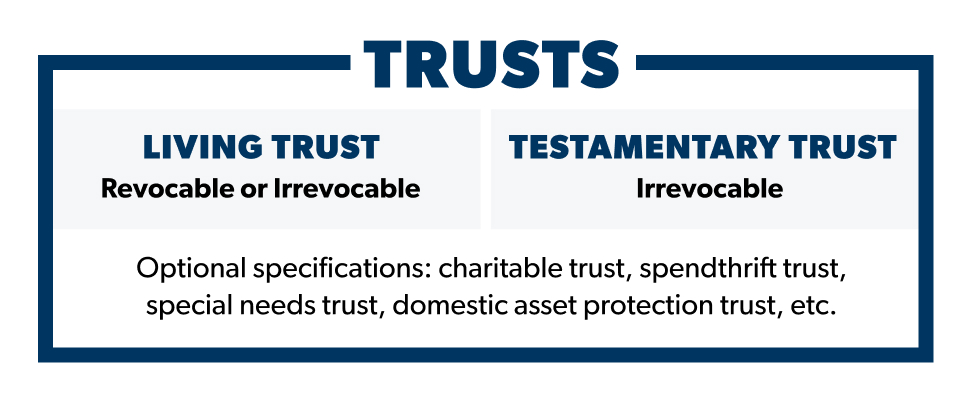

Types of Trusts

Trusts fall into a few different categories and subcategories.

Living Trust

The main purpose of a living trust is to give you more privacy around planning your estate than you can get from a will. Transferring your assets to this type of trust means you grant ownership to the trust while you’re still alive. It also spells out how to distribute your stuff after you pass away. These can be revocable or irrevocable.

What’s the difference between a living trust and a will? Here are some key differences:

- A living trust helps you skip probate costs (but still comes with attorney fees). Any property given through a will is subject to probate. When handled through a living trust, it isn’t.

- A living trust is not a public document like a will. If you have nosy relatives who want to know how things were distributed, a living trust protects that information, unless you (or the trustee) share it.

- A living trust can’t appoint a guardian for your children. We mentioned it before, but this is a major detail. Only a will can name guardians. So if you’re a parent, you definitely need a will (with or without a living trust).

- A living trust takes more time and money to set up. There’s more paperwork—and money—involved with a living trust compared to a will. The exact cost varies widely according to your location and your needs.

- If you want to learn more about living trusts, you can head over to this handy article.

Testamentary Trust

A testamentary trust is a trust that’s written inside your last will and testament (testamentary trust, get it?). So inside the will are directions for a trust to be created and for some—or all—of your assets to be placed inside it once you die.

That’s the big difference between the two main types of trusts (living and testamentary): One is created while you’re alive and the other after you die. And just so you know, you can create more than one testamentary trust within your will.

A testamentary trust is often used when you want to provide for a disabled relative or a minor or if you want someone to receive their inheritance when they reach a certain age or milestone. Typically, the assets (money, jewelry, land, etc.) within a trust are held until a specific time—like a person’s 25th birthday or after their college graduation.

Since the testamentary trust is inside a will, it has to go through probate after you die.

And until the person (or people) named in the trust receive their inheritance, the trustee (person who carries out the trust) has to go to probate court every year to prove they’re taking care of your stuff as instructed and aren’t using it for personal gain. Those probate costs could add up over the years.

Revocable Trust

The revocable trust is by far the most common type of living trust. Just as the name hints, a revocable trust can be changed or revoked (canceled) by the grantor at any time. Doing this is not a quick job, but it can be done, which makes it a flexible option.

Irrevocable Trust

An irrevocable trust is active as soon as you make it and can’t be changed—even by the grantor (the person who sets it up). It takes a judge to decide whether a change can be made, and even then, the circumstances would have to be pretty special. Some people start off with a revocable trust and then convert it to an irrevocable trust later (when they’re more certain of things).

Want more info? Dig deeper with our article on revocable vs. irrevocable trusts.

Probate

Snapshot

Probate is the legal process of settling someone’s estate when they die. On average, it takes six to nine months to complete. A will makes it go much smoother, but a legitimate living trust is the only way to potentially avoid probate.

Probate is the legal process that takes place after someone dies. It makes sure your property and possessions get to the right people and any taxes or debts are paid in full.

Nobody loves probate, but it’s usually necessary. Without an estate plan, probate can be quite messy and take a long time. If you have a will, it will be a lot smoother. Trusts, on the other hand, can actually be used to help your loved ones avoid probate.

How Does Probate Work?

The probate court judge confirms that the will is genuine and authorizes the executor to carry out the wishes of the person who died. Then, the judge stays in touch with the executor to make sure everything gets done.

How Long Does Probate Take?

If there’s a will and no one tries to contest it, the average probate takes six to nine months. But if there isn’t a will, the process could be much longer. Depending on how complex the estate is, you could be looking at several years.

How Can I Avoid Probate?

Probate is usually necessary anytime someone dies. But if you really want to skip probate, your best bet is a living trust that’s been properly funded during your lifetime. You’ll definitely want help from an estate planning attorney to make sure it’s set up well to avoid probate.

Even if you can’t avoid probate, having the right pieces of your estate plan in place can help speed things up. In fact, a will or living trust that’s clearly laid out can help speed probate way up and minimize its impact on the lives of your loved ones. For instance, you can use a trust to pass a specific asset (or assets) to loved ones without it having to go through probate.

But if you die without an estate plan, the probate process kicks up a notch. First, the judge appoints an estate administrator. Then, the administrator works with the court to value the estate, find creditors and beneficiaries, and decide on a fair way to distribute your property.

Check out this article for more info about probate.

Letter of Instruction

A letter of instruction (aka a letter of intent) is an informal document where you can provide personal instructions that aren’t included in your will. The letter of instruction has no legal authority, but it can make things easier on your family by explicitly stating your special wishes.

Because it’s not a legal document, you can write and update your letter of instruction however you want—it could even be handwritten on a piece of notebook paper. But make sure it’s easily accessible and someone like your executor knows where it is.

Decisions You'll Need to Make

Snapshot

You’ll need to figure out who you want to hold active roles in your estate plan and who to name in your will. Then, tell those people about it and ask those with a role if they are willing to carry it out. It’s a good idea to tell everyone involved what’s in your plan before you die so there are no surprises.

Just because estate planning involves making big decisions doesn’t mean it has to be complicated. Let’s simplify things. We’ll walk you through the most important choices you’ll need to make for your estate plan and help you answer these questions:

- Who do I want involved?

- What should happen to my stuff?

- How do I talk about my estate plan?

Who Do I Want Involved?

Choosing the right people to include in your plan is one of the most important decisions you’ll make during the estate planning process. And here’s a good rule of thumb: If you mention someone’s name in your estate plan, you should give that person a heads up that you’ve included them. This will avoid any confusion when the estate plan goes into action.

Wills and Trusts

As we guide you through the main people involved in wills and trusts—start thinking about the people in your life who could fill these roles.

Beneficiaries

A beneficiary is any person or organization (nonprofit or charity) you want to inherit your assets when you pass away. You’ll name them in certain legal documents, like a will, life insurance policy or trust.

Interesting fact: You’ll also name a beneficiary (not a guardian) for your pets. (We know pets are like family, but legally they’re considered your property.)

You can head over to this article to learn more about beneficiaries.

Medical Power of Attorney

Also known as a health POA or an advance directive, this document gives someone the ability to make certain medical decisions on your behalf. It’s usually created alongside your will.

If something happens that leaves you mentally unable to make decisions (like a brain injury), a medical power of attorney becomes the megaphone your family needs to speak into an urgent situation. Without it, their voice—and your wishes—might not be heard.

When you make a medical power of attorney, it lets you choose a person you trust to make those decisions.

Financial Power of Attorney

Just as a health care power of attorney names someone to make medical choices for you, the financial power of attorney names someone to make money decisions for you. Like the medical POA, it’s usually created alongside your will.

The most common use for a financial POA is during a medical emergency. When you’re in that kind of situation, your daily financial needs might not be top of mind. Someone still needs to pay your bills and manage your accounts—like paying your rent or house payment and insurance premiums.

Wills

If you're creating a will, the roles to consider are slightly different:

Guardians

If you have children younger than the age of 18 (also known as minors), you need to name a guardian for them in your will. A guardian will get legal custody of your kids and your kids’ property if you’re not around.

Kind of hard to think about, isn’t it? But hey, this is a big (and necessary) decision. Make sure you decide on someone you trust and someone you believe can take on that kind of responsibility. Then remember to talk it over with that person before naming them in your will.

Warning! If you don’t name a guardian for your children in your will, a probate court will decide that for you—and that’s just not right! No one wants a court to decide something as important as guardianship for children.

Executor of Estate

Your will’s executor (aka personal representative) is the person who carries out the wishes in your will when you’re gone. Your executor will also manage the probate process, get stuff to your beneficiaries, and oversee other duties that require honesty and integrity.

Be sure to pick the right person for the job, someone who can follow your will carefully and responsibly—without getting a lawyer involved. That’s the goal!

Want to learn more about the role of executor? You can read more in this article.

Trusts

If you're making a trust, you'll need to think about who you want to fill these roles:

Trustee

A trustee makes sure the instructions in a trust are carried out (like the executor for your will). You could choose a relative—or even yourself. Or you could appoint a professional trustee (usually from a financial institution).

Unlike an executor, the trustee’s job is usually ongoing, so it can be a pretty big responsibility. Consider someone who has the time and ability to properly manage the trust.

Successor

This is the person who takes over as trustee if the original trustee dies or is no longer able to fulfill their duties.

What Should Happen to Your Stuff?

Assets are valuable possessions that you own (basically, the stuff you own that’s worth money). This can include things like cash, retirement and investment accounts, vehicles, and your house.

One of the big advantages of estate planning is that you get to decide what happens to your stuff. Because if you don’t—someone else (like the state) will. You worked hard to build your wealth. So make sure your stuff gets to the people you care about most—not to your third cousin, Todd, who wants to cash flow his basement casino.

Here are some examples of assets:

Liquid Assets

- Money: checking accounts, savings accounts and the cash you hid in a cookie jar at the back of the pantry (we don’t recommend this by the way)

- Retirement and investment accounts: 401(k)s, 403(b)s, mutual funds, IRAs, stocks/bonds

- Digital money: PayPal, Venmo, crypto, etc.

Physical Assets

- Real estate: home, land, other properties

- Vehicles: cars, trucks, boats

- Contents of your home: jewelry, laptop, lawnmower, heirlooms, collectibles

- Pets (we know they’re like family, but legally they’re considered your property)

How Do I Talk About My Estate Plan?

Talking to your loved ones about what you want to happen after you die can seem intimidating. But it doesn’t have to be. We’ve got some simple steps to help you start the right conversations.

- List the people you need to talk to.

Start with the person you’ll do your estate planning with. That’s your spouse or someone you trust if you’re single. Together, you’ll choose the people you’re going to ask to fill a role in your plan. It’s also a good idea to talk to people who don’t get a vote but will be affected by your will, like your kids, beneficiaries and extended relatives. Take responsibility for what you’ve decided to do and have any hard conversations yourself instead of pushing them off on your loved ones to deal with once you’re gone.

- Think about your relationship with each person.

Can you talk to them easily, or do you tend to argue? Do you have a relative who’s a little too loud about their (unwanted) opinions? Well, they’re still family—and you may have to talk to them about your estate plan. Think about why past conversations have gone well or poorly. With these things in mind, you can plan for risks, take steps to minimize conflict, and set healthy boundaries to protect your decisions—not to mention your sanity.

- Set up meetings with those involved.

Let’s be clear: This will take more than one conversation. You’re trusting your loved ones with sensitive information about what’s most important to you, so this isn’t the time to put everybody in a room and bombard them with your plans. You and your spouse should plan your will privately—no kids or in-laws allowed! When you ask someone to fill a role, meet with one individual or married couple at a time so they can respond and ask questions in a low-pressure setting. Then, after everything’s final, consider small group meetings or even a live reading of the will to tell your kids, beneficiaries or other relatives about the details.

After You Complete Your Plan

Snapshot

Keep your plan in a safe place, and tell the people involved where to find it. Give copies of your plan to those people so they know what they’ll need to do. If anything changes, make sure to update your plan.

Congrats on taking the time to learn what you need for a solid estate plan.

If you were creating one as you went—great job! You’ve done the heavy lifting, and now it’s time to put it all together. Still working on it or just getting started? Keep using this guide to cross the finish line!

Now you may be wondering what to do with your estate plan after you’ve got the right pieces in place. First, let’s explore the last few steps to help you leave a strong legacy. Then, we’ll talk about how to keep your estate plan up-to-date.

Store the Plan in a Legacy Drawer

What’s a legacy drawer? It’s a special place to store the important documents your family needs if something happens to you.

First things first. We do live in a digital world. So it’s possible that your legacy drawer won’t be an actual drawer in your home. It could be online, and that would make perfect sense. But whatever you choose—make sure whoever needs access has it.

Whether you go real or digital, your legacy drawer should include:

- Will and estate plans

- Your ID (copies of passport or driver’s license)

- Passwords

- Marriage (and other) certificates (copies)

- Social security card (copy)

- Financial account information

- Funeral instructions

- Insurance policies

- Other important documents

Having a legacy drawer set up eliminates a whole lot of added stress and confusion at a time when tensions are already running high.

You can find even more tips for your legacy drawer in this article.

Give Copies to the People Involved

Whether you have a will or a trust, it’s always a smart idea to share a written copy of your estate plan with the people who will be involved in carrying it out. It helps them prepare before they have to take action. And if you make a copy of your will, remember—only your original, signed document will be legally binding.

Share a copy of your will with these people:

Personal Representative, Executor or Trustee

Your personal representative manages the process of carrying out your will or trust—so they need to know where that document is. Remember the legacy drawer we mentioned earlier (where you’ll store all your important legal documents)? Tell your personal representative where those documents are and how to access them.

You should also write your personal representative a letter of instruction that includes contact information for guardians, powers of attorney, beneficiaries, financial advisors and anyone else whose help they might need.

Guardians

You should give your child’s guardian (or guardians) a copy of the will and a letter of instruction that includes important information about your child, like their medical history, allergies and some of their favorite things. Then write one more letter—to your child. Tell them how much you love them and anything you want them to know.

And remember—pets get a beneficiary, not a guardian. We’re mentioning that person here because you’ll connect with them and give them care instructions like you would with guardians.

Medical Power of Attorney

If your medical (or health) POA has to make a medical decision for you during an emergency, they’ll need to access this legal form fast. That’s why they should have their own copy of the form (and know how to access your copy in case theirs gets lost or destroyed).

Financial Power of Attorney

Your financial POA should know where and how to access your financial information, but don’t give your account numbers, PINs or other details to them. Even though you trust this person, you don’t want your financial info floating around where it could fall into the wrong hands. You just want your power of attorney to have access to your account information if they need it.

The one thing you can—and should—give you financial POA is a copy of the form naming them as such.

How to Keep Your Plan Up-to-Date

Putting an estate plan in place is a smart move and shows your loved ones you care. But you can’t predict all the twists and turns your life could take, so make sure you keep your plan up-to-date when those twists and turns happen.

So, when and why should you revise your will? There are eight major times when your will needs a makeover:

- Getting married

- Having a child

- Children growing up

- Getting divorced

- Losing someone close to you

- Changing assets

- Moving to a new state

- Changing your mind

Remember to let anyone involved in your will know if you make a change that affects them.

Learn more details about when you should revise your will in this article.