What Is Environmental, Social and Governance (ESG) Investing?

8 Min Read | May 21, 2024

Over the past few years, more and more investors have shown interest in putting their money where their values are. According to a Harvard study, more than a quarter of global investors say ESG is now a key part of their investment approach (26%).1

But is environmental, social and governance (ESG) investing—sometimes known as impact investing—the answer?

We’ll go ahead and admit that we’re not fans of impact investing. It’s great that people want to make a difference in the world, but there are better ways to save the rainforest than putting your investments at risk.

ESG investing takes the concept of values-based investing to a whole new level—and not in a good way. With ESG investing, mutual fund companies decide on which companies to invest in based on certain environmental, social and governance criteria (hence the acronym ESG). If we’re being honest, it’s essentially virtue signaling at the expense of your retirement savings.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

And we’re not the only ones who feel that way. Politicians, investment firms and concerned investors are pushing back on companies with an ESG agenda, saying issues like climate change and social inequality shouldn’t be the driving factors in their investing decisions. (And they’re right.) The truth is that ESG-focused investment firms are more concerned about bullying business leaders into running their companies based on hot-button issues instead of delivering the best possible return for their investors.

While we hope ESG is just another fad and not the future of investing, it’s important for you to understand how it works and why we don’t recommend it as an investment option.

What Is Environmental, Social and Governance (ESG) Investing?

As investors explore the idea of “doing well by doing good,” brokerage firms and mutual fund companies have started to offer mutual funds and exchange-traded funds (ETFs) that contain stocks from companies that meet certain environmental, social and governance standards.

This approach to investing is an example of impact investing, which tries to channel investment dollars into stocks and funds that both benefit society and provide a profit for investors. Other types of impact investing like ESG include socially responsible investing (SRI) and sustainable investing.

How Does ESG Investing Work?

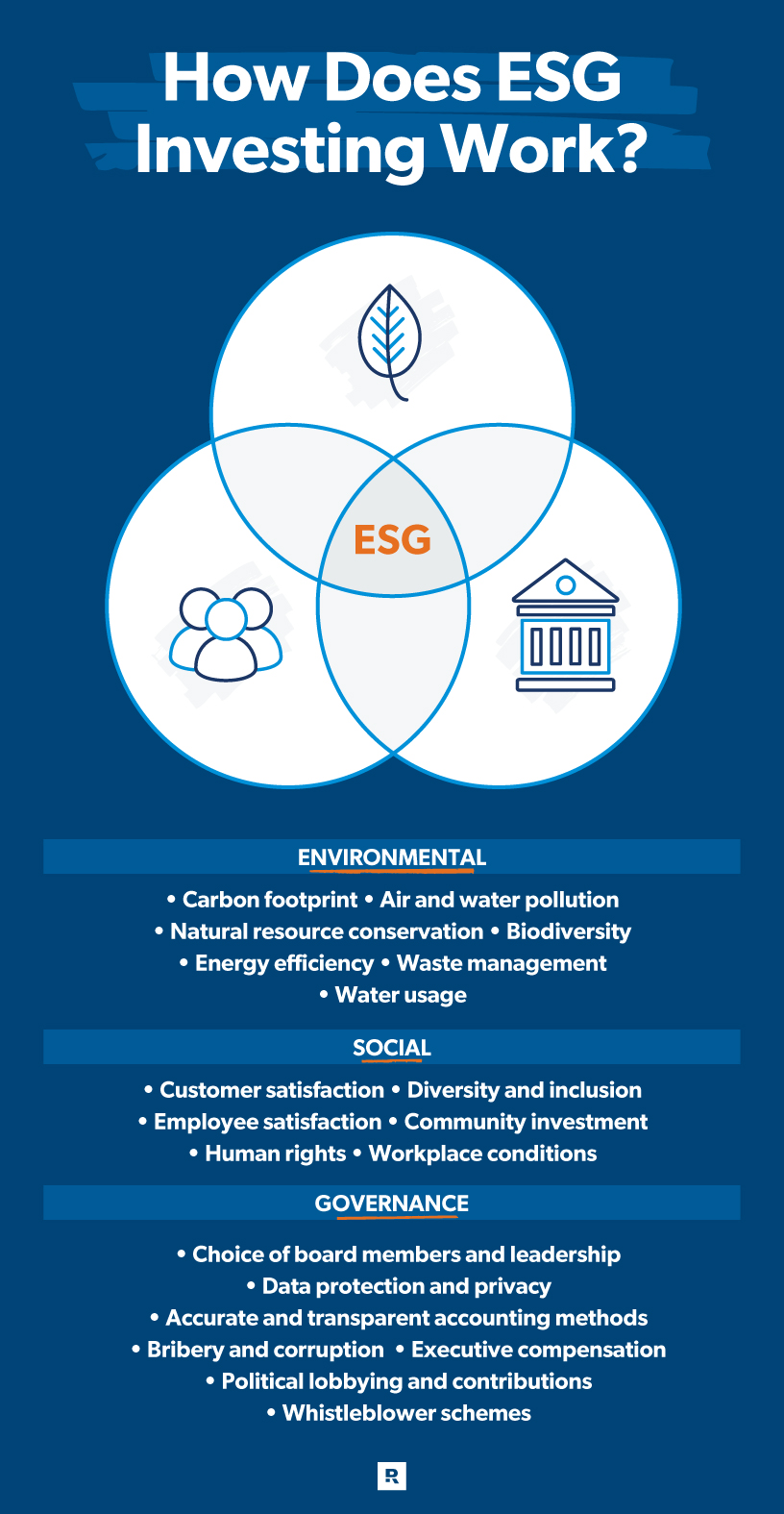

If we’re going to understand how ESG investing works, we have to dive deeper into what it means when a company gets high marks for environmental, social and governance criteria. (If this seems like a report card, you’re right.) Let’s start by unpacking what each of these ESG factors is all about:

Environmental

ESG investors look at how a business’s practices affect the environment—from their use of renewable energy sources or harmful chemicals to their efforts to lower their carbon footprint or reduce waste (including somehow getting rid of cow farts—can’t make this stuff up). It’s all fair game and includes issues like:

- Carbon footprint

- Air and water pollution

- Natural resource conservation

- Biodiversity

- Energy efficiency

- Waste management

- Water usage

Social

When it comes to social factors, ESG investors want to know how “ethical” a company is when it comes to how they treat their employees, suppliers and customers.

Here are some factors that fall into the social category:

- Customer satisfaction

- Diversity and inclusion

- Employee satisfaction

- Community investment

- Human rights

- Workplace conditions

Governance

This aspect of ESG pops the hood of a company and examines how it does business. ESG investors want to know how transparent a company is with their business practices and how hard its leadership pushes for social change.

Some things fund managers and investors will look at include:

- Choice of board members and leadership

- Data protection and privacy

- Accurate and transparent accounting methods

- Bribery and corruption

- Executive compensation

- Political lobbying and contributions

- Whistleblower schemes

Essentially, they’re making sure a mattress company is actually selling mattresses instead of pulling off a Bernie Madoff Ponzi scheme from the back office. It does make you wonder though . . . why are there so many mattress stores around in this day and age? Very suspicious, if you ask us . . .

There are a handful of independent research firms that evaluate companies and give them ESG rankings based on the criteria above, and also look at how ESG drives profitability.

Then, mutual fund companies use a company’s ESG ranking to decide whether to include that company’s stock in their fund. They could also decide to remove a company’s stock from an existing fund if their ESG ranking falls below a certain threshold. So, if your company’s paper straws don’t save enough sea turtles, watch out, because you could get voted off the island.

When you buy an ESG mutual fund or ETF, you’re investing in companies that meet a brokerage firm or mutual fund company’s ESG criteria, whatever those criteria might be.

But keep in mind: There’s no universal agreement about what ESG actually means. One firm’s criteria for environmental impact or corporate governance might be different than another’s. This is one of the major problems with ESG—no one can agree on what it means!

What Are the Pros and Cons of ESG Investing?

Fans of ESG claim this approach to investing will have a positive impact on society. Critics, meanwhile, point out that investors are settling for worse returns while there’s little to no evidence that ESG makes a difference at all. Let’s take a closer look at both sides of this heated debate.

Arguments in Favor of ESG Investing

1. Positive Impact

In theory, ESG investing allows people to put their money where their mouth is and support companies working toward goals, values and causes that are important to them.

2. Long-Term Focus

ESG investing encourages companies to consider the long-term impacts of how they do business. As a result, more companies are putting sustainable practices in place and changing the way they make high-level decisions.

3. Risk Management

ESG advocates argue that when companies put sustainability principles into action, they lower the chance of investing in companies more likely to be rocked by scandals, controversies, and other public relations debacles that could hurt their financial performance and stock prices. (Remember Enron?)

Arguments Against ESG Investing

1. Lower Returns

This is probably the biggest red flag when it comes to ESG funds. In 2022, the 10 largest ESG funds suffered double-digit losses, and eight of those funds underperformed the S&P 500.2 Overall, two-thirds of active ESG funds underperformed the market.3

2. Limited Investment Options

ESG investing limits your investment options. Some sectors or companies might not meet the criteria set by the mutual fund companies picking stocks to include in their ESG funds.

For example, ESG-focused funds typically steer investors away from energy companies, which have been the best-performing businesses in the S&P 500 over the past year or so. They also tend to shy away from stocks that have historically produced well-above-average market returns—and can hold up well when the economy hits a rough patch—like gun makers and aerospace and defense companies.

3. Higher Fees

Since ESG funds require more research and analysis on the front end by the fund manager, they may charge higher fees than traditional funds for the cost of putting these funds together. This could cut into your returns even more.

4. Lack of Agreement Over Standards

While most folks have a general idea of what ESG is, there’s no standard definition or measurement for ESG criteria. This makes ESG rife for inconsistent and biased assessments of companies across the board. Is Company X ESG-friendly or not? Who’s to say?

With all this in mind, you can’t help but think ESG is a bogus investing method. This virtue signaling is all about making companies “look good”—not about actually doing good.

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

Is ESG Investing a Good Idea?

Here’s the bottom line: You should never invest based on ESG. When in doubt, avoid a fund that factors in ESG criteria because chances are those funds will see a drop in returns and underperform against other funds in their category. Meaning: You’re going to lose money. And that’s the exact opposite goal of investing.

Mutual fund managers have one job and one job only: to pick stocks for their funds that will give you the best return on your investment. Federal law states retirement savings must be invested for the sole purpose of providing retirement benefits and minimizing the risk of large losses.4

But instead of doing their jobs, ESG fund managers are more concerned about sitting on their high horse, making sure businesses check off a bunch of arbitrary boxes based on standards no one can fully agree on. Do you really want to bet your retirement future on that?

Here’s our advice. When choosing mutual funds to include in your investing portfolio, stick with what works. Look for good growth stock mutual funds that have a strong track record of solid returns. That means if a fund hasn’t been around for more than 10 years and is not outperforming the benchmark for its category over time, then you shouldn’t invest in that fund—ESG or not.

We recommend investing in four types of mutual funds: growth and income, growth, aggressive growth, and international. When you divide your investments equally between those four funds, you diversify your portfolio enough to lower your investment risk and still benefit from the stock market’s growth to help you combat inflation.

Look, there’s nothing wrong with wanting to save the planet. But there are better ways to make an impact and contribute to causes you care about without putting your nest egg at risk.

Next Steps

- There’s no sugarcoating it—investing can be really confusing. But it doesn't have to be! If you want to take a deeper dive into investing, take a closer look at Ramsey's investing strategy.

- Our R:IQ Retirement Assessment can help you figure out how big your nest egg should be based on a bunch of different factors. It also gives you an idea of how much you should be saving each month to reach that number.

- Our SmartVestor program can connect you with investment professionals who can guide you through the investing process and answer your questions so you can pursue your goals with more confidence.

This article provides general guidelines about investing topics. Your situation may be unique. To discuss a plan for your situation, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.