Study Summary

- Nearly 6 in 10 say now that many parts of the country are returning to pre-pandemic life, they are ready to spend money to treat themselves.

- 82% say that even though many things are returning to normal, they are still very cautious with their spending.

- 70% of qualifying parents say they are afraid to spend the child tax credit money from the new monthly payments because they don’t know how it will impact their income taxes when they file next year.

- 3 in 4 have noticed higher prices in the last three months for the things they normally buy.

- 60% of recent home buyers paid more than the asking price for their recent home purchase.

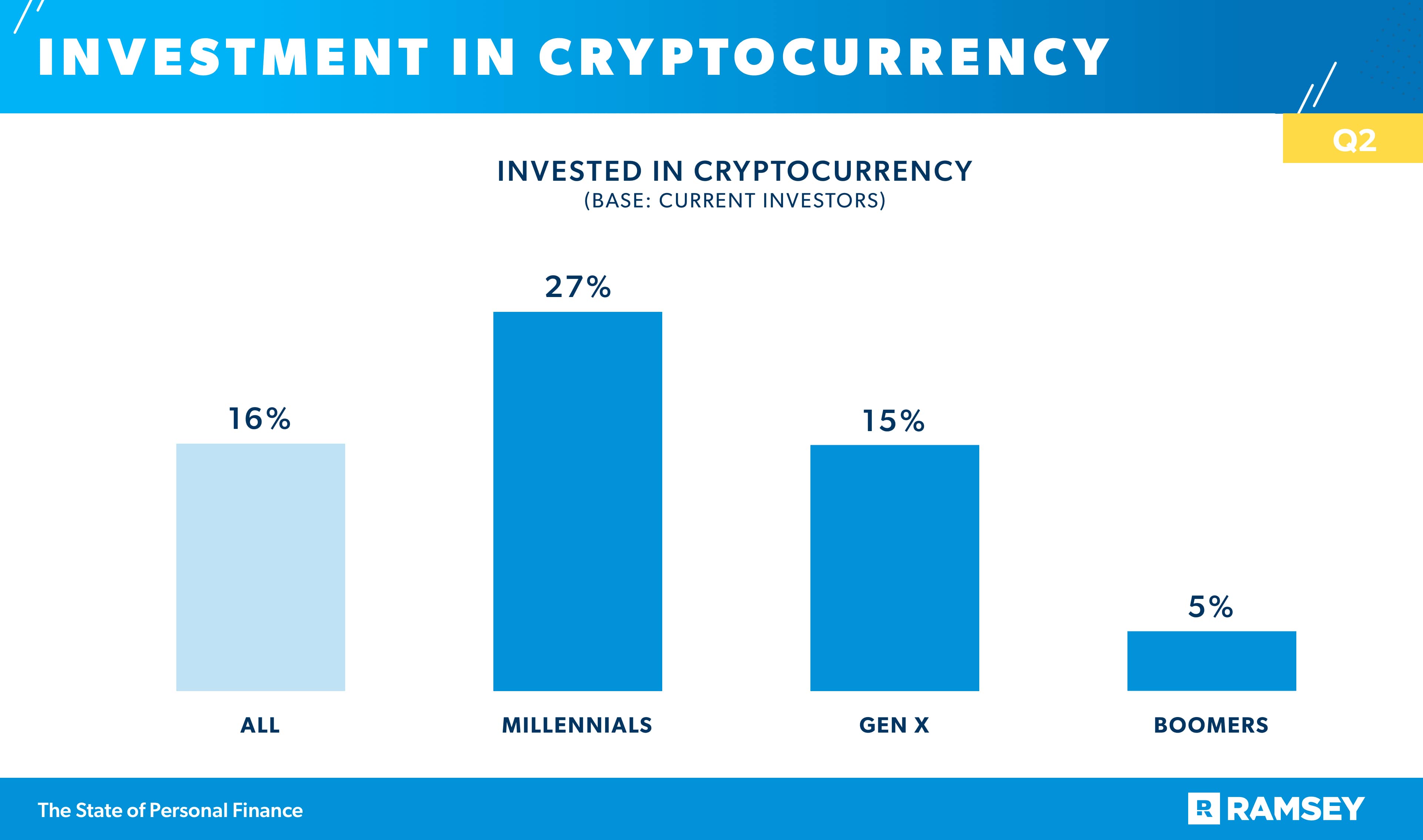

- 16% of investors have invested money in some form of cryptocurrency.

- 41% of married couples say they often fight with their spouse when they talk about money.

Downloads

- Research Report (PDF)

- Press Release

- Infographics

Have questions about this study? Email us or visit our newsroom for more information.

As Americans regained some normalcy over the summer with easing restrictions, new research finds people are feeling cautiously optimistic about their financial situation. A lot of Americans feel like they’re better off financially than they were this time last year, but they’re still proceeding with caution before they ramp up their spending. The latest quarterly release of The State of Personal Finance study from Ramsey Solutions digs into these issues as well as the impact of inflation on Americans’ household finances, confusion around child tax credit payments, and concerns about a booming seller’s real estate market.

Many Have Major Purchases Planned, but Still Cautious With Spending

Many Americans are beginning to feel the economy is on the mend, and after a long season of uncertainty and restraint, consumers are ready to cautiously return to more normal spending patterns. Nearly six in 10 say that now that many parts of the country are returning to pre-pandemic life, they are ready to spend money to treat themselves. In fact, 63% have a big ticket or major purchase planned for the next three months. Not surprisingly, summer travel tops that list of upcoming big spending. More than one-quarter (27%) plan to spend money on a vacation in the next three months. Millennials especially plan to increase their travel spending this summer, with 45% of those planning a summer vacation saying they will spend more this year than last year on those trips. Comparatively, only one-third of Gen X and 29% of Boomers plan to spend more on summer vacations than they did last year.

But Americans haven’t forgotten the money lessons they learned during the COVID-19 pandemic. Many Americans who reined in spending and ratcheted up savings to ride out the pandemic say some of those habits are here to stay. In fact, three in four say they plan to make some of the spending changes they made during the pandemic permanent. And 82% say that even though many things are returning to normal, they are still being very cautious with their spending.

Lack of Clarity Around New Child Tax Credit Payments

This hesitancy to spend has carried over into other financial decisions as well. Recent changes to the child tax credit allow eligible parents to receive half of their tax credit in monthly payments between July and December of this year. Parents can receive monthly payments up to $250 per qualifying child ages six to 17 and $300 a month per child under age six. Parents claim the rest of their credit amount when they file their 2021 taxes in 2022. But a majority of the parents who qualify for the monthly payments are wary about spending the money now.

Seven in 10 qualifying parents say they are afraid to spend the child tax credit money from the new monthly payments because they don’t know how it will impact their income taxes when they file next year. The latest quarter’s study found that only half of qualifying parents say they clearly understand what this new child tax credit means for their tax situation. And those with lower household income are even less likely to say they have a clear understanding. Nearly 40% of those with a household income below $50,000, 44% of those with a household income of $50,000–99,999, and 60% of those with a household income of $100,000 or above say they clearly understand the impact of these new monthly payments on their income taxes.

And even though they have a better understanding of the child tax credit, families with a higher household income are more likely to say they don’t plan on spending their checks because they don’t know how it will affect them at tax time. Fifty-seven percent (57%) of those with a household income under $50,000, 67% of those with a household income of $50,000–99,999, and 78% of those with a household income of $100,000 or above are afraid to spend the child tax credit money for fear of how it will impact their taxes.

But unless they opted out, qualifying parents have already started receiving their monthly tax credit payments, and families are split on how to handle that extra cash. Thirty-eight percent (38%) of qualifying parents say they will save the payments, 35% say they will pay bills with them, 28% say they will invest the payments for their child’s future, and 27% will spend the payments on necessities for their child or family.

Inflation Impacting Spending

While consumers are cautiously optimistic about the economy and their spending, many shoppers have noticed their money doesn’t seem to go as far. Eight in 10 of those surveyed say they don’t feel like their money buys as much as it used to. And three in four say they have noticed higher prices in the last three months for the things they normally buy.

As the value of their dollars shrink, many consumers are changing their buying habits. Shoppers’ top solution to combat higher prices was to seek out sales or coupons before they purchased items (38%). One-third (32%) told us they have purchased less than they normally would because of higher prices, and 29% said they delayed a purchase because of the inflated cost.

A Hot Real Estate Market Causing Concern for Those Hoping to Purchase

If there’s anywhere higher prices are making waves, it’s in the housing market. Demand is high, and in many markets, the supply can’t keep up. The data from the second quarter’s study shows that for those who bought a house in the last three months, 60% report paying more than the asking price for the house. And for those planning to buy soon, these real estate trends are generating concern. An overwhelming majority (80%) say they are concerned they won’t be able to compete because the market is so hot in their area. And three in four are concerned they won’t be able to find a home in their budget.

These trends are having the biggest impact at the top of the market. Among households making $100,000 and above, 70% say they paid over asking price for homes they purchased in the last three months, compared to 56% of households making $50,000–99,999 and only 37% of households earning under $50,000 who purchased a home in the last three months. Similarly, households making over $100,000 are more likely than households making under $100,000 to say they are concerned they won’t find a home in their budget in the next three months (83% compared to 71%).

Even more concerning than budget constraints and competition are the tactics many home buyers are adopting in order to compete. Three in four of those who are planning to buy a home in the next three months said they would be willing to waive the home inspection and appraisal to make their offers more competitive. That decision for short-term gain could leave home buyers open to long-term risk as they struggle to navigate the demanding housing market this summer.

Younger Investors Increasingly Exploring Cryptocurrency Investment Options

Results from the Q2 study show that newer types of investing, including new investing products like cyptocurrency and new ways to invest like robo-advising are catching on, especially with younger investors. Sixteen percent (16%) of those who are currently investing have invested in cryptocurrency. Millennial investors have embraced the trend more than other age groups, with 27% investing in some form of cryptocurrency, compared to 15% of Gen X investors and only 5% of Boomer investors.

Millennial investors are also more likely to adopt tech-based investing platforms like robo-advising and app-based investing platforms. More than half of Millennial investors (51%) have tried out investing apps like Robinhood, compared to one-third of Gen X investors (32%) and only 5% of Boomer investors. The same trend holds true for robo-advising platforms. Forty-four percent (44%) of Millennial investors have invested money using robo-advising platforms, while only 22% of Gen X investors and 4% of Boomer investors have.

This higher likelihood to opt for more DIY investing options may stem from the higher confidence Millennials have in their ability to invest. Just over half of Millennials (51%) who are investing say they are “extremely confident” in their ability to invest their money, compared to only 32% of Gen X investors and only 11% of Boomer investors.

How Money Impacts Marriages

Whether it’s planning a big purchase, deciding how cautious to be with post-pandemic spending, or deciding how to handle child tax credits, money decisions can be tricky for married couples who are not on the same page about their finances.

Among those who are married, 41% say they often fight with their spouse when they talk about money.

Additionally, 37% of married couples say their spouse has made them feel guilty about how they spend money. Younger couples struggle with this more than older married couples. Nearly two-thirds of Millennials (65%), 41% of Gen X, and only 11% of Boomers who are married report that their spouse has made them feel guilty about how they spend money.

Fights and hurt feelings aren’t the only financial issues married couples deal with. The Q2 data shows that one-third of those who are married admit to having hidden a purchase from their spouse that they didn’t think their spouse would approve of. Others reported that they don’t have fully combined finances, with 31% saying they have a credit card their spouse doesn’t know about and another 31% saying they have a debt their spouse doesn’t know about.

And not surprisingly, debt can make financial problems for couples even worse. This study tracked several troubling financial behaviors among married couples, and those with consumer debt did not fare as well as those who have no consumer debt. More than half (54%) of married couples with consumer debt say they often fight with their spouse when they talk about money, compared to only a quarter (25%) of couples who are consumer debt-free. And couples with consumer debt are twice as likely (50% compared to 23%) to say their spouse has made them feel guilty about how they spend money.

Conclusion

While 37% report that their personal finances are better off now compared to this time last year, with only 18% saying they are worse off year over year, many Americans are feeling better headed into the second half of the year. However, as the latest data from Q2 shows, Americans are still navigating the changes that affect their household finances, including child tax credits, inflation, housing concerns and a cautious attitude toward spending.

About the Study

The State of Personal Finance Study is a quarterly research study conducted by Ramsey Solutions with 1,004 U.S. adults to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded June 22, 2021, to June 29, 2021, using a third-party research panel.