5 Ways Ramsey+ Helps You Budget Better

5 Min Read | Oct 4, 2022

EveryDollar's a fantastic budgeting tool. But if you really want to up your budgeting game, you should give Ramsey+ a free test-drive. Now, you’re probably asking yourself, What is Ramsey+, and—more importantly—how does it help me become a better budgeter?

That’s exactly the question we’re ready to answer. Right here. Right now.

What Is Ramsey+?

A Ramsey+ membership gives you exclusive access to the courses that teach you how to take control of your money—and to the tools you need to make it happen.

Let’s talk about five ways a Ramsey+ membership will help you budget your absolute best.

1. You get all the EveryDollar premium features.

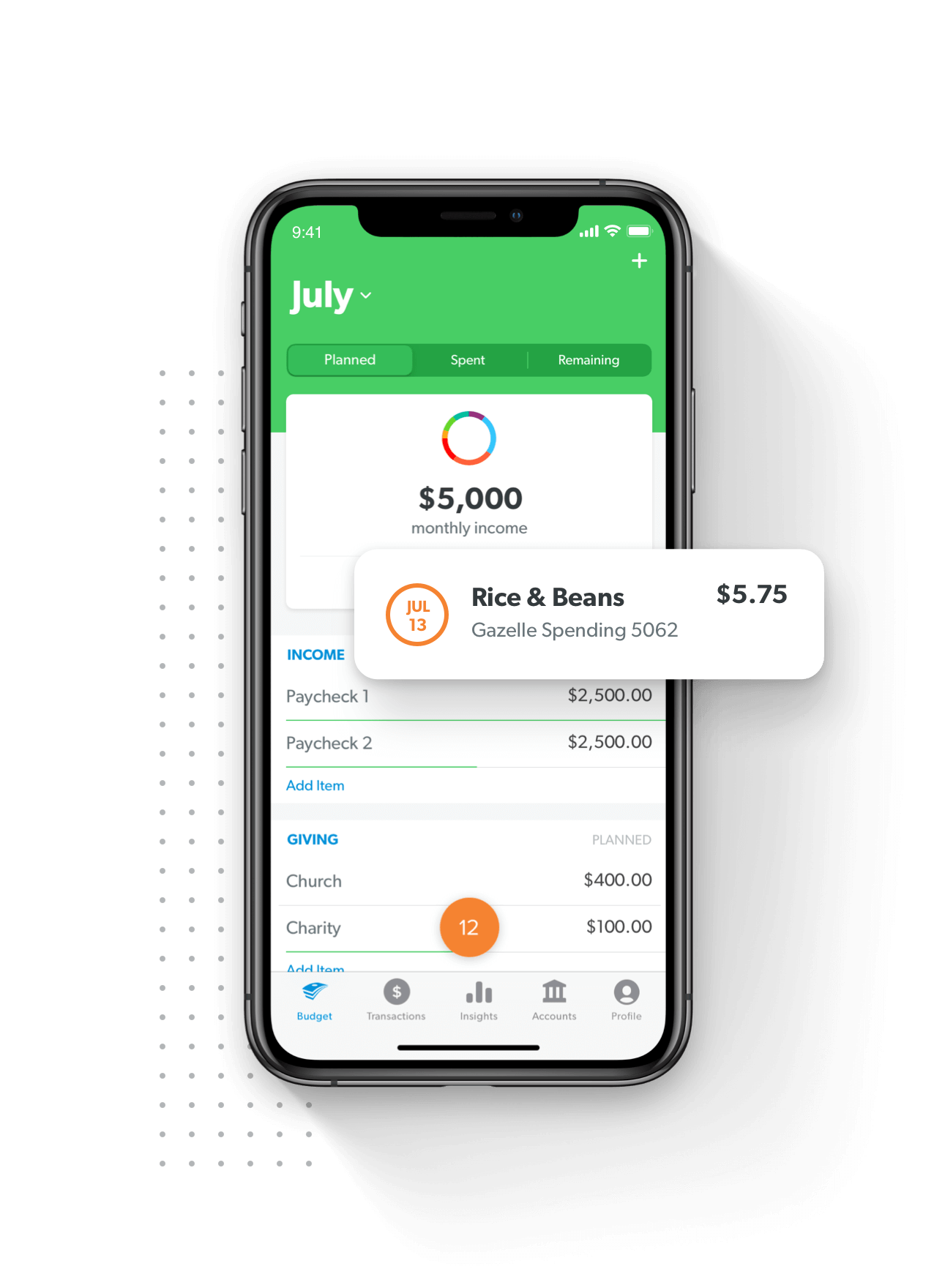

With your Ramsey+ membership, you get the premium version of EveryDollar (once called EveryDollar Plus). What’s so “premium” about it? Well, you can do next level things like:

- Connect with your bank so your transactions stream right in. This helps you track your transactions quickly and accurately. Every. Time.

- View all your accounts in one place inside your budget.

- Get custom reports on your spending and income. (More on that later.)

- Quick callout: You can get these particular premium features by upgrading your EveryDollar budget. But we've still got awesome Ramsey+ exclusive features to talk about.

2. You can watch budgeting lessons for your stage of life.

When you’re building your budget, it’s not a one-size-fits-all sort of situation. That’s why we made Budgeting That Actually Works. You’ll learn how to budget no matter your money goals, relationship status or income.

Because you know you should budget at every stage of life. But maybe you don’t know exactly how. Well, after watching these lessons, you won’t have any more excuses. And without those excuses holding you back, you’ll be ready to budget like nobody’s business. Boom.

3. You get custom budgeting reports.

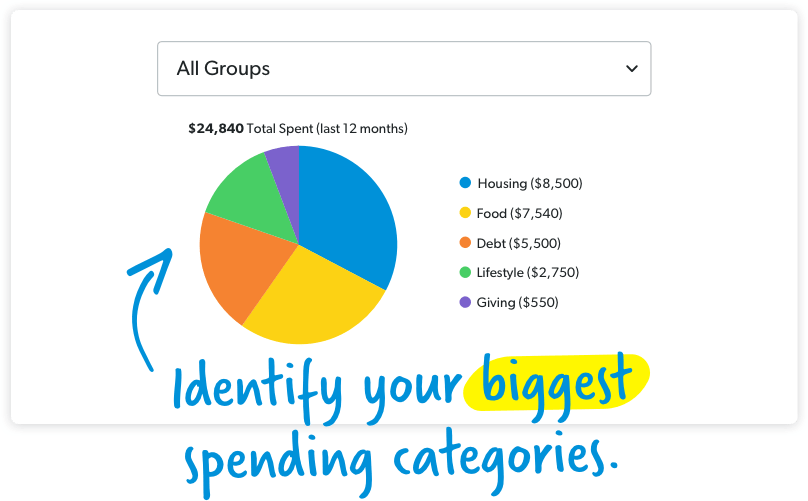

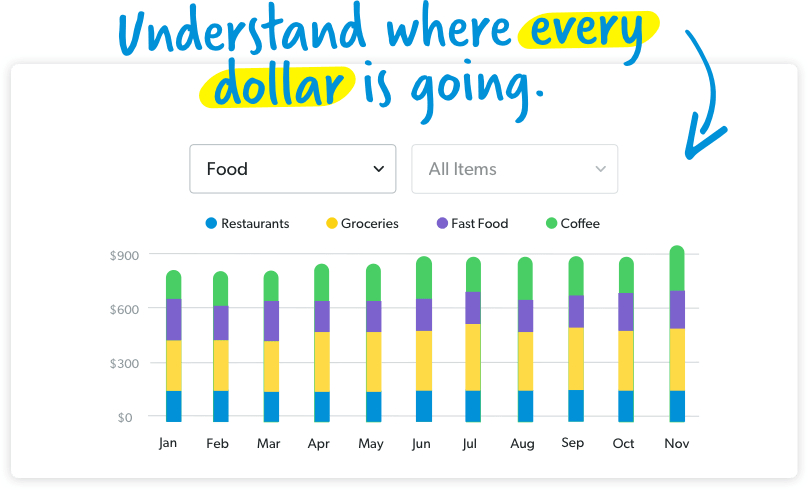

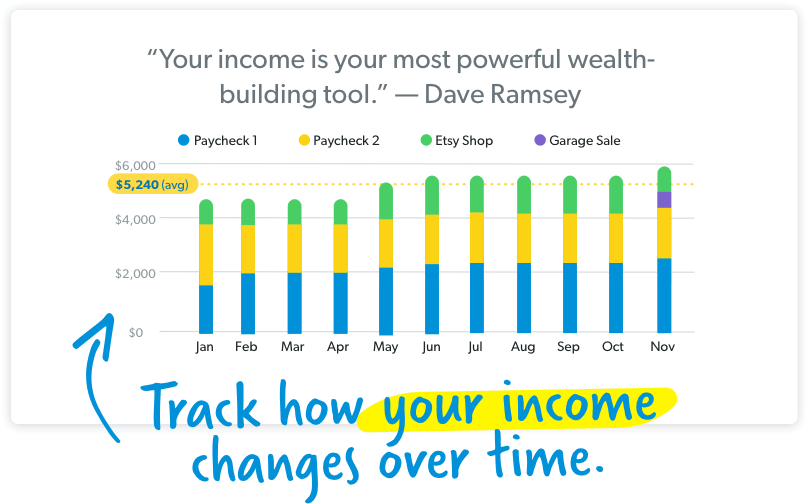

Budget reports are one of the biggest requests we’ve gotten from EveryDollar budgeters. And now, they’re here! As a Ramsey+ member, you can use the Insights page on the desktop version of your account to show reports on your income and spending. At a glance, you’ll see how your money habits line up with your money goals.

Here are some of the reports you’ll have access to:

Spending Totals: Check in on your total spending. If you need to, make changes to your budget to get your spending—and your goals—back on track.

Spending Breakdown: A budgeter favorite, this section makes it clear where your money’s going. Dig into categories that seem too high and find ways to spend less so you can save more!

Monthly Income: Have an irregular income? No problem. Once you’ve budgeted for a while, you’ll be able to see your high and low months in one spot. Plus, this chart will show you how those side hustles are stacking up month over month.

4. You’ll learn the proven money plan.

So, if you want to do the right things with your money, you need to know the proven money plan. It’s called the 7 Baby Steps, and all of Ramsey+ is built on it. The Baby Steps walk you from saving up $1,000 for a starter emergency fund to paying off your debt—all the way to living and giving like no one else. And when you work the plan, the plan works. Period.

But let’s be honest: Just hearing the steps (or looking at this handy picture) is helpful. But Ramsey+ does more than tell you the steps. It teaches you how to put them into action—with unlimited streaming of our online money courses, including Financial Peace University, Smart Money Smart Kids, Legacy Journey, The Ultimate Guide to Getting Rid of Student Loan Debt, and (the course we already mentioned) Budgeting That Actually Works.

Start budgeting with EveryDollar today!

Financial Peace University (FPU) has already helped nearly 10 million people do exactly what you want to do: manage money the best way possible. In the first 90 days of taking the course, the average household pays off $5,300 in debt and saves up $2,700 for emergencies. Look at those numbers and imagine how much momentum you’d have in your budget to knock down your own money goals. You can take FPU on its own, but with Ramsey+, you get this and a whole lot more.

5. You’ll learn the why behind how you handle money.

One of the many benefits you get as a Ramsey+ member is access to free audiobooks! Right now, you can listen to Rachel Cruze's latest book, Know Yourself, Know Your Money, to see how your personality and past affect how you deal with money today and what you can do about it!

Plus, there's a whole video series and a Know Yourself Money Assessment tool—all free for Ramsey+ members who want to really dig in here.

We won’t deny it: Budgeting can be hard. But it’s a heck of a lot easier when you’ve got the tools and teachings you need. Ramsey+ empowers you to budget your way to total control of your money.

You can do this. You really can. You just have to start. And guess what? Right now, you can start for free! Get your free trial to Ramsey+ and start budgeting your absolute best.