Last year, the IRS sent out more than $345 billion in tax refunds, with the average refund clocking in at almost $3,200.1 With that kind of money suddenly back in your hands, it would be so easy to blow it all on a gadget, a vacation or a new spring wardrobe.

But before you book that cruise to the Bahamas or buy that new pair of shoes, take a step back and think things through.

Think about how much more peace you’d have if you used that money to move you and your family one step closer to becoming completely debt-free. Or what if you put that refund back into savings? Maybe then you could get a good night’s sleep without worrying about how you’d pay the bills if you lost your job tomorrow.

Get expert money advice to reach your money goals faster!

The point is, your tax refund (which is simply the government returning money that should have been in your pocket all along) could help you make some real progress on your money goals . . . if you don’t spend it all in one place.

So if you do wind up with a hefty tax refund this year, what should you do with your refund? It honestly depends on where you are on your financial journey, but here are a few ideas to help you get started!

1. Pay Off Debt Faster With Your Tax Refund

About a third of folks plan to use at least part of their tax refund to pay off debt, according to a survey by the National Retail Foundation.2 But we ran some numbers to find out what would happen if you got gazelle intense and used your entire refund to pay down your debt. You might be surprised by how much you could actually save in interest and payments with this one simple step.

Student Loans

The average student loan balance is nearly $37,000.3,4 So, let’s say your balance is $37,000 at a 6% interest rate on a 10-year loan. With a monthly payment of $410, you’ll shell out about $49,300 in principal and interest.

But let’s say you put your $3,200 tax refund toward your student loan balance. Using our student loan payoff calculator, you’ll see you can pay off your loan a year earlier and save more than $2,400 in interest.

Now, let’s take things a step further. Getting a $3,200 tax refund doesn’t mean you hit the jackpot. It’s simply the government returning your money that you’ve been overpaying them—money you could have been using all year long to pay extra on your debt. Your goal should be to have a tax refund as close to zero as possible so you’ll have more money in your paycheck.

Don’t wait until next year to get your money back. Work with a tax advisor or your payroll department to adjust your withholding today so you can bring home an extra $266 a month ($3,200/12), starting with your next paycheck!

Then you can use that money to pay a little extra each month on the remaining balance of your student loan debt. With this method, you’ll pay your loan off in a little over five years instead of 10. And you’ll save an additional $5,300 in interest!

That’s how you put a tax refund to work! Here’s how that same scenario can work on your other debts:

Credit Cards

Households with debt currently owe about $16,700 in credit card debt.5,6 Yikes! If you paid only the minimum payment of 3% of the balance, and with a 15% interest rate, it’ll take you 20 years to pay that off. But if you chuck that $3,200 tax refund at the balance when you get your refund and add $266 to your monthly payment after adjusting your withholding, you’ll knock that sucker out in just a few years and save yourself thousands of dollars in interest!

Car Loans

The latest research shows that the average used car loan is almost $27,800 at a 10% interest rate.7 Most people finance their cars for five years, although the average term is creeping toward six. With your one-time $3,200 payment followed by your increased monthly payments of $266, you’ll pay off your wheels almost three years sooner and save more than $5,100 in interest!

Home Loan

As home prices continue to rise around the country, the average mortgage balance now sits around $236,000—and that number keeps on going up.8 Let’s assume you have a 15-year mortgage with a 5% interest rate. Using our mortgage payoff calculator, you can see that with your tax refund and increased monthly payment of $266 (from your newly adjusted withholding), you’ll pay off your home nearly three years early and save more than $18,800 in interest!

2. Use Your Tax Refund to Save for Emergencies

Here’s a fact that should be a wake-up call for everyone: Nearly one-third of Americans (32%) wouldn’t be able to cover a $400 emergency today.9 That’s a huge problem, and it’s probably why half (50%) of Americans plan to put part of their tax refunds into savings last year.10

Here’s the deal: You need to have 3–6 months’ worth of expenses saved up in an emergency fund (or have a starter emergency fund of $1,000 if you’re still paying off debt) to help protect you financially from anything life throws your way.

If you don’t have enough money in the bank to cover a tire replacement or a trip to the emergency room, your tax refund can give your emergency savings a much-needed boost. And that’s a way more responsible option than spending it all on a late-night online shopping spree. (Resist those impulse purchases!)

3. Invest More for Retirement With Your Tax Refund

As long as you have $1,000 in a starter emergency fund, you should use your tax refund to pay down your debt. But if you’re out of debt and have 3–6 months of expenses saved for your fully funded emergency fund, use our investment calculator to see how your tax refund can do great things for your retirement account.

With an initial investment of your $3,200 tax refund followed by monthly contributions of the $266 you gained after adjusting your withholding, you could add nearly $831,000 to your nest egg over 30 years! That’s just $95,760 of contributions but more than $732,000 of growth. This is one simple way to catch up if you’re feeling behind on your retirement savings goals.

Work With an Expert Tax Pro

Remember that a tax refund is not a bonus—it’s your money that you’ve been loaning to the government all year long without interest. It’s money that should have been in your pocket this whole time. Don’t make that mistake again this year!

An experienced tax professional can help you get your taxes done and work with you to adjust your tax withholding so you aren’t giving the government more than they’re owed from each paycheck.

Get in touch with a RamseyTrusted tax pro who serves your area so you can get going on your debt snowball or retirement fund as soon as possible. Find a tax advisor near you today!

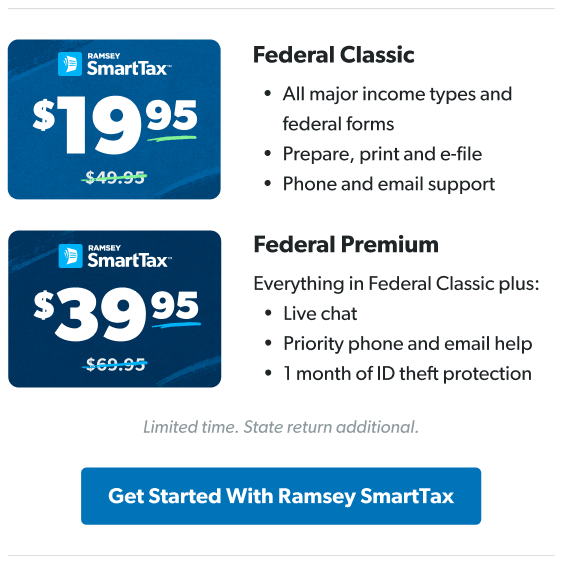

Or if you’re confident you can handle your own taxes and just want an easy-to-use tax software (without the hidden fees), check out Ramsey SmartTax—it makes filing your taxes easy and affordable.