Money is personal.

Coaching should be too.

SmartDollar Financial Coaches meet employees where they’re at and help them work our proven plan—the same plan that’s helped millions take control of their money.

Money is personal.

Coaching should be too.

SmartDollar Financial Coaches meet employees where they’re at and help them work our proven plan—the same plan that’s helped millions take control of their money.

Money is personal.

Coaching should be too.

SmartDollar Financial Coaches meet employees where they’re at and help them work our proven plan—the same plan that’s helped millions take control of their money.

Our coaches are unique—every one of them is a Ramsey Preferred Coach and bases their financial guidance on Dave Ramsey’s proven money principles.

Your employees need someone they can trust when it comes to money. Whether it’s getting out of debt, saving up for big money goals, or just getting on the same page as their spouse, our trained coaches will walk with them as they make real progress with their money.

Our coaches are unique—every one of them is a Ramsey Preferred Coach and bases their financial guidance on Dave Ramsey’s proven money principles.

Your employees need someone they can trust when it comes to money. Whether it’s getting out of debt, saving up for big money goals, or just getting on the same page as their spouse, our trained coaches will walk with them as they make real progress with their money.

Our coaches are unique—every one of them is a Ramsey Preferred Coach and bases their financial guidance on Dave Ramsey’s proven money principles.

Your employees need someone they can trust when it comes to money. Whether it’s getting out of debt, saving up for big money goals, or just getting on the same page as their spouse, our trained coaches will walk with them as they make real progress with their money.

Here’s How It Works:

Employees sign up for a 50-minute virtual coaching call through SmartDollar (free to employees).

Each employee is paired with a SmartDollar Financial Coach who will take the time to understand the employee’s unique situation.

The coach will then develop a custom plan and assign action items for the employee inside of SmartDollar.

Employees will receive ongoing support and motivation from their individual coach.

Here’s How It Works:

Employees sign up for a 50-minute virtual coaching call through SmartDollar (free to employees).

Each employee is paired with a SmartDollar Financial Coach who will take the time to understand the employee’s unique situation.

The coach will then develop a custom plan and assign action items for the employee inside of SmartDollar.

Employees will receive ongoing support and motivation from their individual coach.

Here’s How It Works:

Employees sign up for a 50-minute virtual coaching call through SmartDollar (free to employees).

Each employee is paired with a SmartDollar Financial Coach who will take the time to understand the employee’s unique situation.

The coach will then develop a custom plan and assign action items for the employee inside of SmartDollar.

Employees will receive ongoing support and motivation from their individual coach.

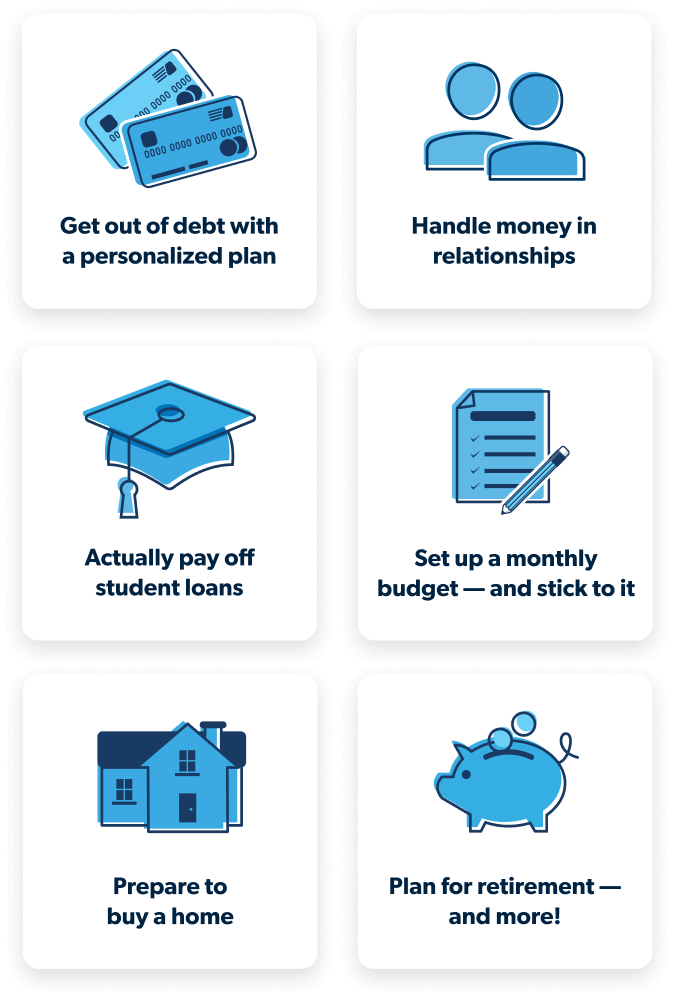

SmartDollar Financial Coaches Can Help Your Employees:

SmartDollar Financial Coaches Can Help Your Employees:

Get out of debt with a personalized plan

Handle money in relationships

Actually pay off student loans

Set up a monthly budget—and stick to it

Prepare to buy a home

Plan for retirement—and more!

Frequently Asked Questions

-

Who are the coaches?

-

SmartDollar Financial Coaches are trained by Ramsey Solutions to help employees identify the root problems that lead to poor financial decisions and solve them using our proven plan, the 7 Baby Steps. Coaches work with employees to create healthy behaviors and mindsets to set them up for lasting financial success.

-

Are the coaches certified?

-

SmartDollar Financial Coaches are different—because we know fancy titles and letters behind names don’t mean much. (What the heck is an ICFE Certified Credit Repair Specialist or a Certified Mindfulness Life Coach, anyway?)

What employees really need is a financial professional with the heart of a teacher.

Every SmartDollar Financial Coach has completed Ramsey Solutions’ Financial Coach Master Training and bases their financial guidance on Dave Ramsey’s proven plan for money, the 7 Baby Steps.

SmartDollar Financial Coaches have helped SmartDollar users pay off over $1.9 million of debt and save over $1 million! -

Do the coaches give investment advice?

-

No. Unlike financial advisors, who focus on creating investment strategies and financial plans, SmartDollar Financial Coaches focus on behavior change and provide practical next steps for employees.

Many employees believe they should be investing when they really need to be tackling the mountain of debt in front of them or learning how to budget. Your employees’ income is their largest wealth-building tool. So when they’re no longer having to use it to pay off debt, they can start to save and invest in their futures!

SmartDollar Financial Coaches will never give investment advice but will meet employees where they’re at and help them crush their money goals! -

Can employees book multiple one-on-one coaching sessions?

-

Yep! Employees can meet with a SmartDollar Financial Coach as many times as they want. We’ve found that most employees like to meet with their coach between four to six times a year.

SmartDollar makes it easy for employees to rebook with the same coach. That way, they can build a trusted relationship with their coach over time. -

Who pays for one-on-one coaching?

-

The cost of one-on-one coaching is covered by employers as an optional add-on to SmartDollar. Employees will never be charged for individual coaching sessions.

-

Does one-on-one coaching replace SmartDollar?

-

Not at all! SmartDollar Financial Coaches walk employees through the same principles outlined in SmartDollar and will assign them action items within SmartDollar during their call.

Think of it this way: SmartDollar is the gym, and the coach is the personal trainer. Sometimes you need a little extra help to get started and stay on track! -

How much does it cost?

-

Companies purchase one-on-one coaching at $67 per session.

To work with a Ramsey financial coach outside of SmartDollar, it typically costs between $200 to $350 per session.