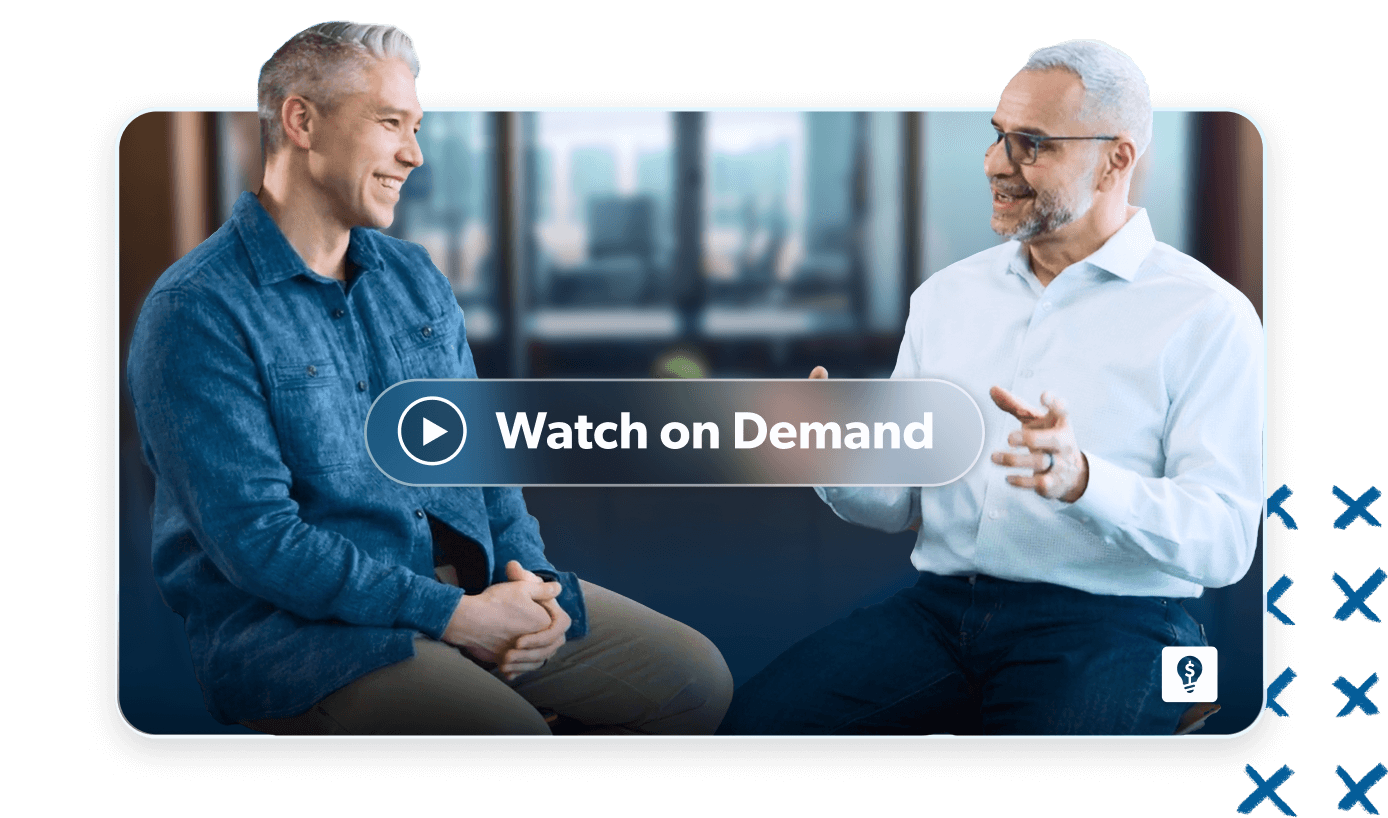

Armando Lopez, Senior Executive Director of Human Resources at Ramsey Solutions, sits down with Ramsey Personality Eddie Culin for a conversation on how HR leaders can bring real financial wellness to their teams. With decades of experience in human resources, Armando has spent his career supporting employees and strengthening company culture. In this session, he shares practical strategies HR professionals can use to introduce a life-changing financial wellness benefit that helps employees take control of their money while supporting the business as a whole.

-

Internal Funding

Strategies -

External Funding

Options -

Creative Cost-Saving

Approaches

Discover which funding source works best for your company:

General Operating Budget

The most straightforward option. Use funds directly from your overall operating budget to support financial wellness.

Government Grants and Tax Incentives

State and local programs may offer grants or incentives for businesses investing in financial wellness that strengthens communities.

Grant Funding From Foundations and Nonprofits

Some foundations and nonprofits offer grants designed to promote financial wellness and financial education.

Employee Benefits Budget

Many organizations already have funds set aside for employee benefits like health insurance, retirement plans, and paid leave. Financial wellness is a natural fit and can make other benefits more effective.

Retirement Plan Assets

In some cases, retirement plan assets can be used to support financial wellness education that encourages participation and reduces withdrawals.

Wellness Funds

If you already offer wellness programs, you may be able to redirect funds from low-impact initiatives into a financial wellness benefit that delivers measurable results.