The 2022 SmartDollar

Employee Benefits Study

Learn how employees feel about financial wellness benefits

from their employers, the financial concerns they're facing,

and other workplace trends impacting today’s full-time workforce.

The 2022 SmartDollar

Employee Benefits Study

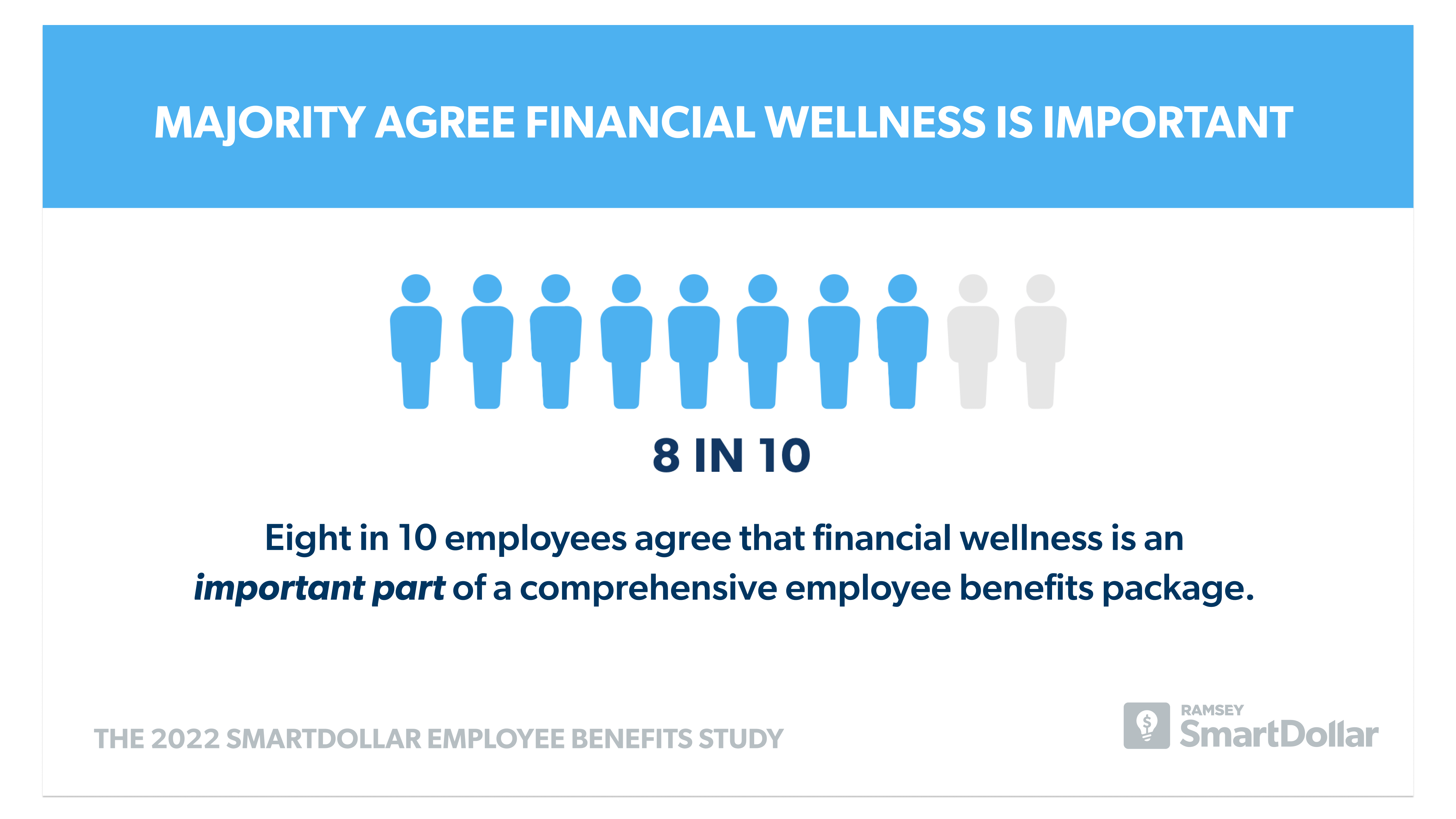

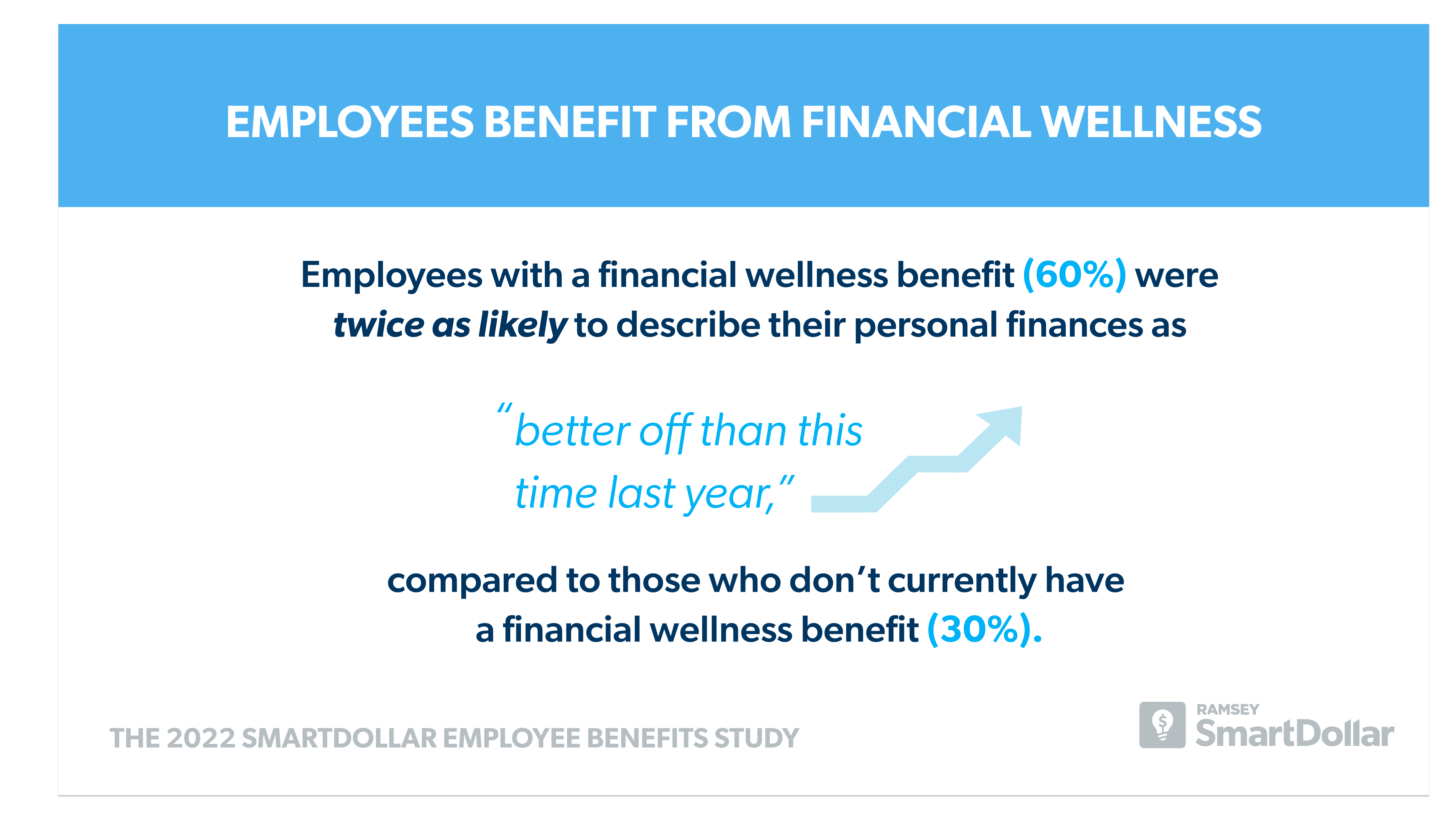

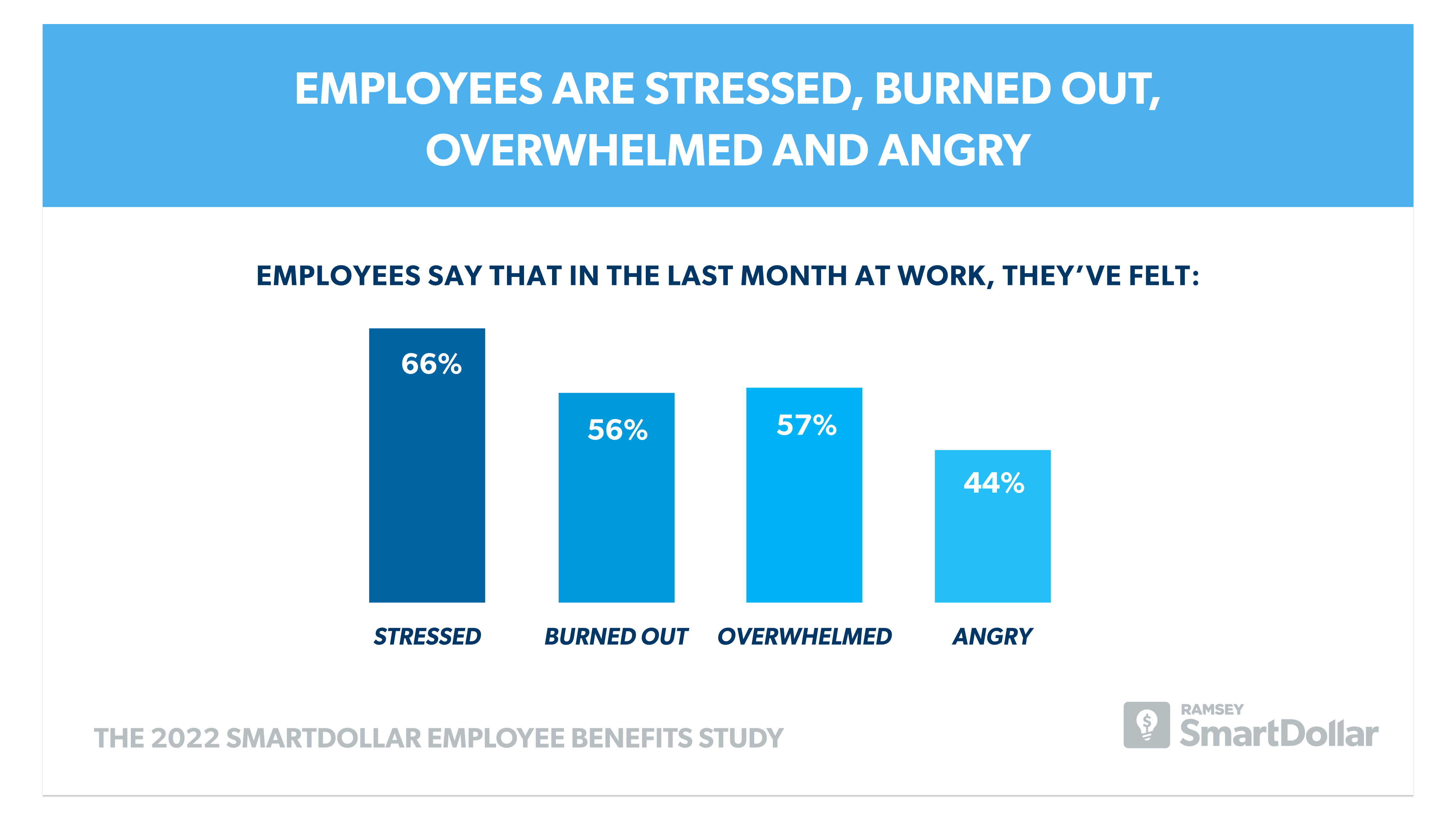

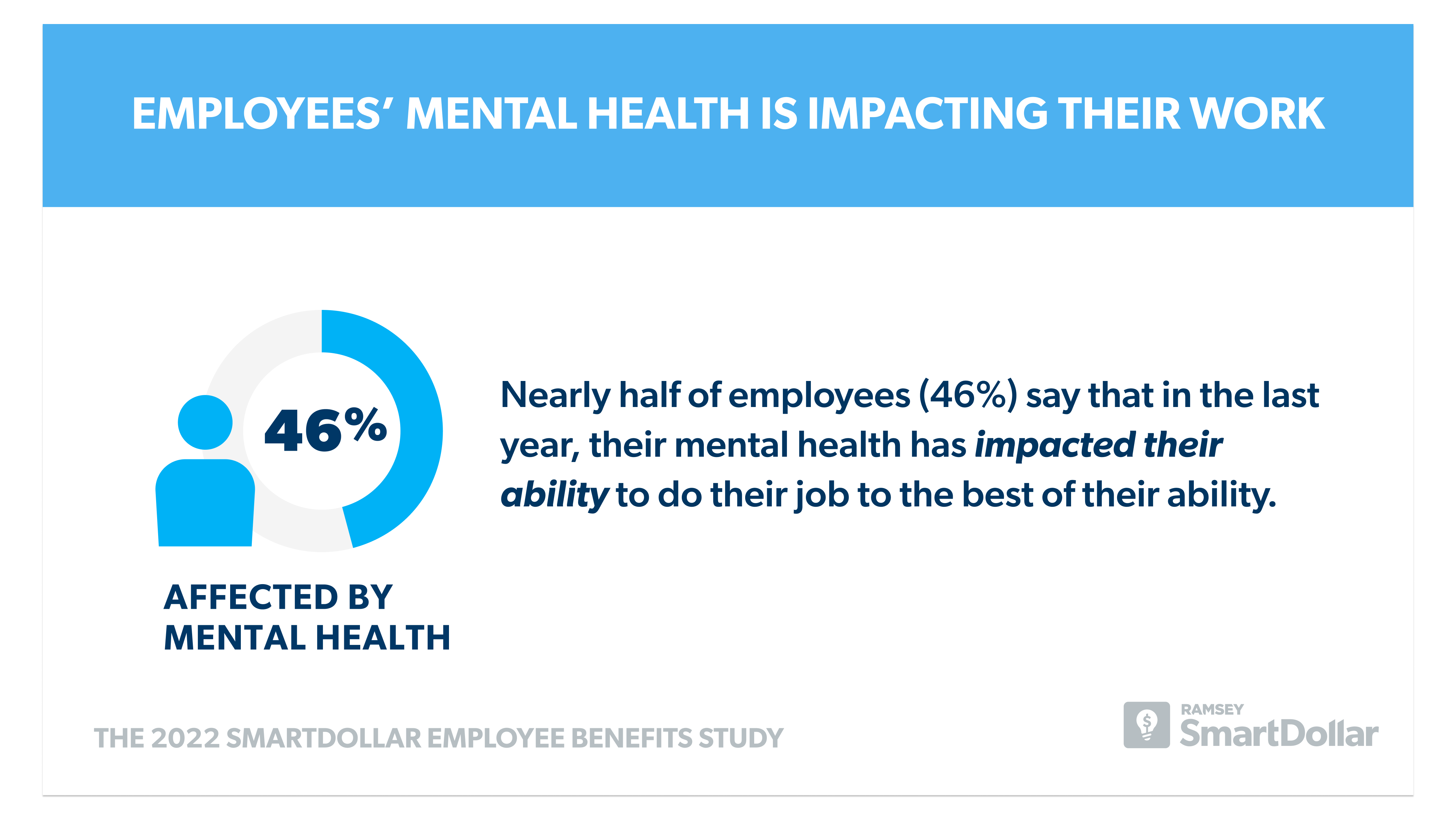

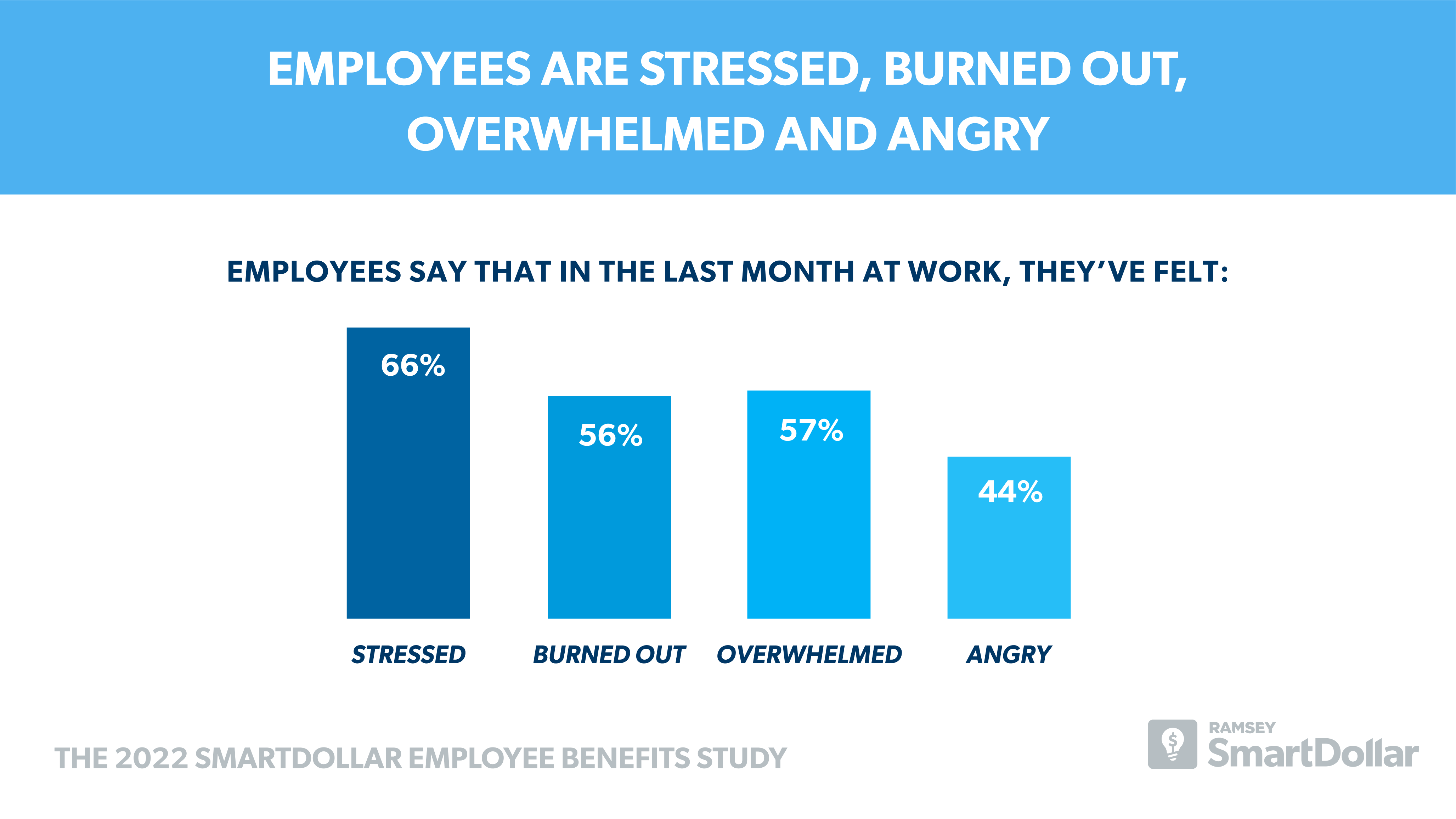

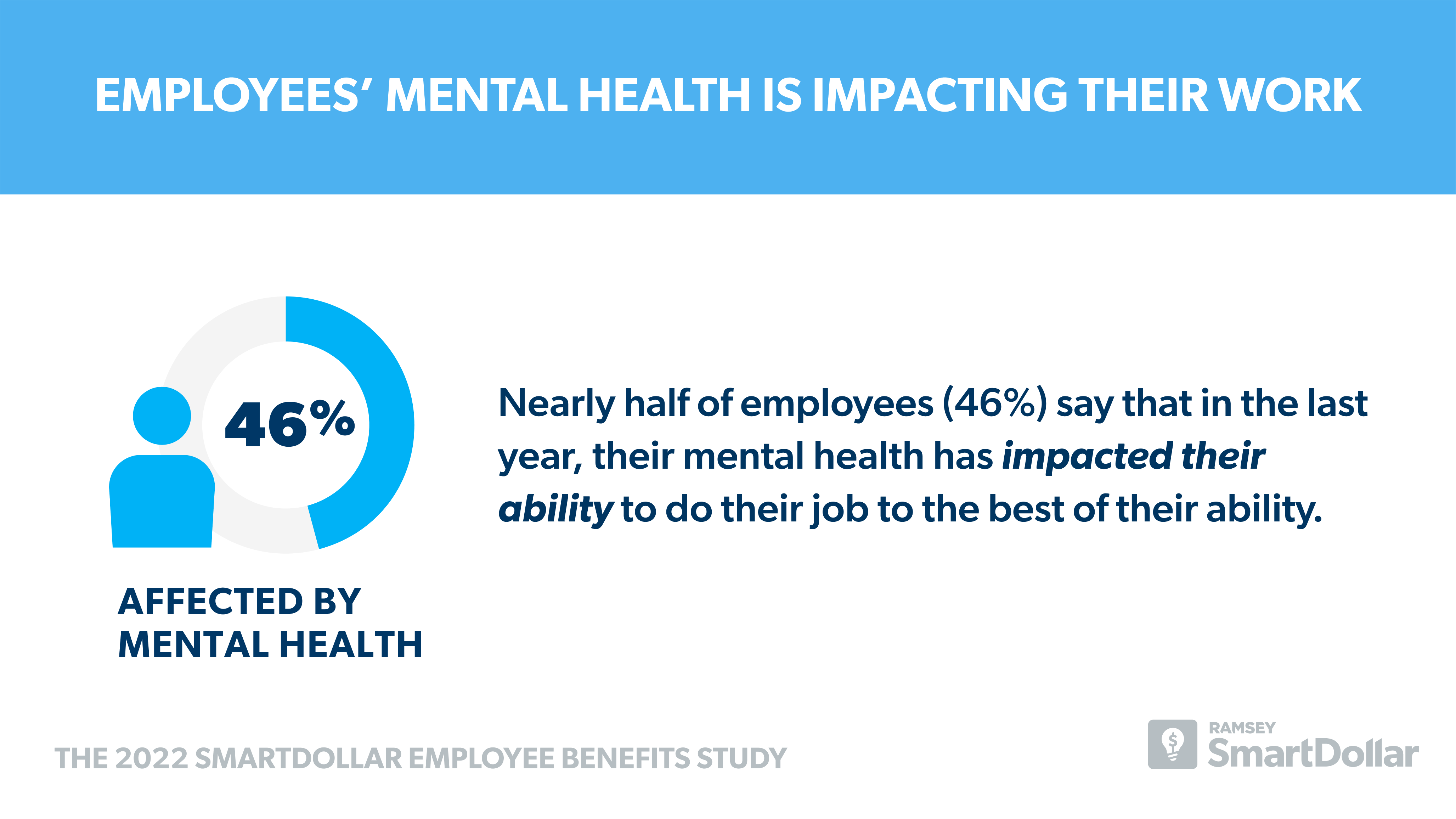

Learn how employees feel about financial wellness benefits from their employers, the financial concerns they're facing, and other workplace trends impacting today’s full-time workforce.

The Research

Ramsey Solutions conducted a study of more than 3,000 full-time American employees working at organizations with 25 to 3,000 employees and who receive benefits through their employer. The study covered topics including employee benefits, perceptions of and engagement with financial wellness benefits, employee financial and mental health, and other trends impacting today’s workforce.

Key Takeaways

The Research

Ramsey Solutions conducted a study of more than 3,000 full-time American employees working at organizations with between 25-3,000 employees and who receive benefits through their employer. The study covered topics including employee benefits, perceptions of and engagement with financial wellness benefits, employee financial and mental health, and other trends impacting today’s workforce.

Key Takeaways

About Ramsey SmartDollar

SmartDollar is an employer-provided financial wellness benefit from Ramsey Solutions that helps employees budget, get out of debt, save for the future, and retire with confidence using Dave Ramsey’s 7 Baby Steps.