3 Lessons We Learned From a No-Spend Summer

6 Min Read | Nov 7, 2023

If you have kids (or hope to have them at some point), I’m willing to bet you want them to build good money habits early on in life so they’ll grow up to be successful, debt-free adults. But let’s be real: It can be intimidating to know how to teach big financial concepts to little ones in a way that will stick with them.

I recently had a funny experience where some of the things I teach about money actually came back to haunt me, but it led to trying a no-spend summer as a way to show my kids the power of saving. And before you say, “No-spend summer? No thanks!” and run for the hills, let me share what that looked like for our family.

How It Started

Here’s the backstory: I always say you should let your kids earn a commission by doing chores (instead of just handing them an allowance like an ATM). That way they can really start to understand that money comes from work and learn firsthand how to give, save and spend money wisely when they get it.

So, my kids—mostly my two oldest, Amelia and Caroline—started doing chores and earning cash. But then, every single time they got money, they wanted to spend it immediately. I was getting hit with a million questions a day: “Can we go to the store? Can we look on Amazon? Can we buy this?” I mean, it was constant, you guys. I could see my sweet kids turning into materialistic impulse buyers before my eyes, and it was driving me and my husband, Winston, absolutely crazy. We just wanted our kids to earn some money so they could understand that spending isn’t a bad thing and it’s okay to enjoy what you earn, but we realized we had to set some limits. That’s when Winston and I declared a no-spend summer.

Now, when we said “no-spend summer,” we meant that our kids wouldn’t be spending their money. Winston and I would still be spending our own money because we’re adults (and we’ve got a pretty good handle on this give, save, spend thing by now). The official rule was that our kids couldn’t ask us if they could buy anything new for the entire summer break. That’s a long time for a kid, but to keep them motivated, we promised to match whatever amount of money they each saved over the course of the challenge. They’d be rewarded for their patience by getting double the amount of money they saved on their own, and Winston and I wouldn’t have to live through a whole season of constant pestering.

How It Went

You might be wondering if we were able to pull this off or if we threw the whole idea out the window after a couple tantrums. Well, if you’ve ever spent any amount of time around young kids, you can probably imagine that the experience wasn’t completely flawless. We still had our moments—especially whenever Amazon packages showed up at the door and the kids got super excited, thinking the packages were for them. (Sorry, guys.)

But honestly, the whole thing went a lot better than we even expected. It was so healthy for them to take a break from spending, and it was definitely helpful for me and Winston to try something new since we’re constantly looking for ways to teach our kids about money. They got used to the no-spend part eventually and learned a lot in the process.

Want to Teach Your Kids About Contentment?

Rachel Cruze’s new book—complete with rhyming words and adorable animals—is a great reminder that more “stuff” won’t bring lasting joy.

What We Learned

Speaking of learning, here are some of the biggest lessons and money principles my kids were able to latch on to through this experience.

The Power of Saving

Of course, in the real world, the money you save doesn’t necessarily get matched dollar for dollar. But because of our no-spend summer, my kids were able to see in a very real way that patience pays off and leads to better results—and bigger bank accounts—later on. (This concept will also translate to the idea of compound interest when they start learning about investing.)

Use the best tools to teach your kids about money.

Plus, when my kids’ minds weren’t constantly occupied by spending, they had more room to think about giving too—another super important money habit to start practicing from a young age.

How to Avoid Impulse Buying

Americans impulsively spend about $276 every single month, you guys. That’s about $3,312 in just one year!1 It can be so addicting to keep getting what you want right when you want it, and that’s why it’s great for kids to learn how to pause and take some time to really think about a purchase before spending. They’ll have way more self-control (which will help them out in all areas of life), and they’ll save way more money.

Contentment

When you set strong boundaries around buying things, your kids have to learn how to live with the things they already own. And as a result, they start to be more thankful for those things, allowing them to practice both gratitude and contentment.

This exercise forced my kids to get creative and figure out other things to do besides just going to the store and spending money on the next new toy—and you know what? They still had so much fun. And even though Winston and I weren’t participating in the no-spend part ourselves, it was still such a good reminder for us that stuff isn’t what’s important. Summer was even sweeter when we chose to focus on the joy of being together as a family, making awesome memories, and appreciating everything we already have.

All right, that’s my recap of our no-spend summer! I’d absolutely recommend that every family with young kids try this at least once. And now that summer’s over, we’re going to be back to the regularly scheduled programming, so we’ll see if those lessons carry over into the school year. (If not, we may be doing a no-spend winter—stay tuned.)

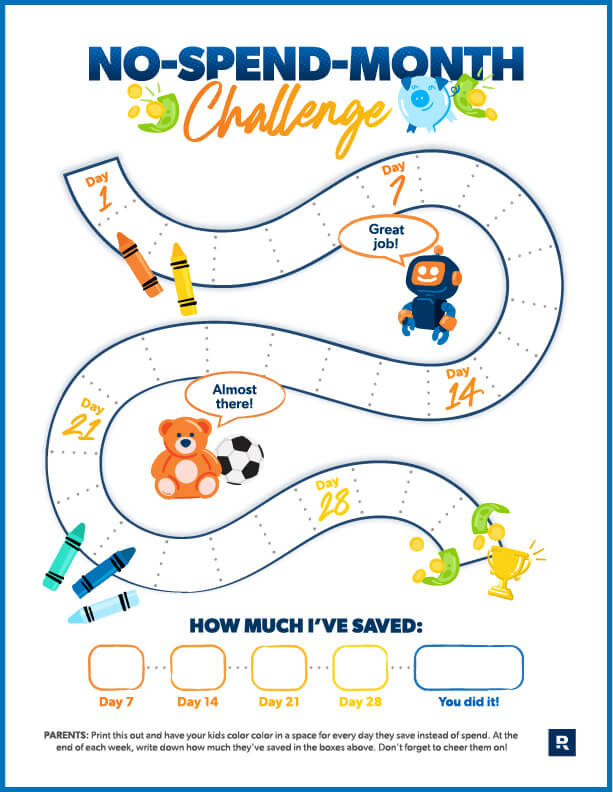

If you think you might want to try something like this with your own kids, it doesn’t even have to be a whole season. You could start by just trying one month. To help make this easy and fun, my team and I created a No-Spend-Month Challenge that you can download and print and have your kids color in as they save. Happy no-spending!

No-Spend-Month Calendar

Get your printable calendar straight to your inbox!