3 Actions Every High School Grad Should Take

4 Min Read | Oct 13, 2021

At 18, the world is your omelet—you can top it however you like. It’s the golden age when you leave high school and land in a place of never-ending freedom.

Did you know that, in college, you don’t have to ask to go to the bathroom? You just get up and go. You can grab a “fourth meal” at your leisure and decide exactly how and where to spend your time.

While the rush of independence is exciting, it can also be a bit overwhelming.

Take a deep breath, relax, and realize you’re not alone. It’s okay to be intimidated as long as you do something about it. Being proactive is extremely rewarding.

As you walk across the graduation stage, consider three actions you can take to make the most of your next big phase in life.

1. Make New Friends

Walking into your first college class or moving into the dorm is a little scary. You’re surrounded by unfamiliar faces who are all thinking the same thing: I hope they like me. Take comfort in the fact that a warm smile and a welcoming attitude go a long way in making new friends.

With a sea of freshmen to choose from, making the right friends is the real concern. After all, you are who you hang with. It helps to focus more on who you hope to be when you graduate than who you are now. Build relationships with people who encourage you to grow, and don’t be afraid to encourage others to grow as well.

2. Find a Church Home

It’s easy to avoid finding a new church in college when you’re alone, so grab a friend and walk through the search process together. Look for a church with an active college group where you feel comfortable and are challenged in your walk. Getting plugged into a local church early will keep you grounded in your faith as you become more independent.

Join a ministry on campus to participate in service opportunities in your new community. Be sure to also keep in touch with your youth pastor and visit your church when you go home.

3. Budget for Success

Freedom as a young adult means you are in control. You decide how much money comes in and how much money goes out.

Thankfully, you’ve still got the chance to manage your money before it starts managing you. Get ahead by budgeting for college in the following areas.

- Ramen Noodles, Roommates and T-Shirts: Before doing anything else, you’ve got to secure the walls of your financial house: food, shelter, basic clothing, transportation and utilities. Write down your estimated costs, use cash envelopes wherever possible, and evaluate actual costs at the end of each month.

- Hooptie Repair: Many college grads remember the pain of trying to get to work or class with a broken-down car and no money. Accidents and emergencies do happen. Be prepared by setting aside $500, and commit to only using it for real emergencies. Friendly tip: Use graduation gift money and summer income to quickly boost your emergency fund.

- Laptops and Spring Break: Determine how much money you’ll need for big expenses and when you’ll need it. If you’re going to the beach for spring break in five months and plan to spend $300, you should save $60 per month. Trust us, paying cash for a trip makes the sand between your toes and the sunshine on your face feel so much better.

Use our basic budget form to get started today. By the time August arrives, you’ll be ready to teach your finance professor a thing or two.

Be smart with life decisions now and you’ll actually be able to enjoy the results of your hard work later.

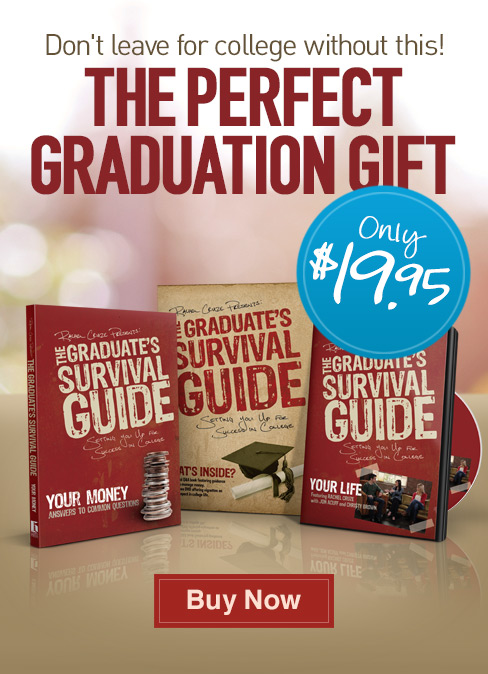

Use the best tools to teach your kids about money.

Want to learn more about planning for life after high school? Check out the books and tools that can help you gain confidence now and for the future.

What life decisions can you make now that you'll be able to enjoy the results of later?