This will be a moment in our life that I will be able to point to and say, "That was a turning point." My wife and I have made more positive moves with money in the past nine weeks than we did in the previous 15 years.

Kevin from Wisconsin

When you’re not stressed about money, you have breathing room in your life. That’s what Ramsey+ can do for you.

Like Michelle, millions of people have discovered how to stop worrying about money and start living. They took control, scored some quick wins, and developed lifelong habits. And you can too.

Ramsey+ gives you the confidence, the tools and the plan you need to build your savings, pay off debt early, and keep more of your money.

Pay $0.00 today with your 14-day free trial.

Cancel anytime. No hassle.

12 Months for

After 14-Day Free Trial

Renews yearly.

Millions of people have discovered how to take control of their money and get rid of their debt for good with Ramsey+.

This will be a moment in our life that I will be able to point to and say, "That was a turning point." My wife and I have made more positive moves with money in the past nine weeks than we did in the previous 15 years.

Kevin from Wisconsin

I made a 180 in my life with my finances and in turn melted my anxiety away, making me a happier person. I no longer have to worry about things. I have been slowly turning my friends and family toward this program because I want them to feel the same financial security I have.

Tony from Florida

This is LIFE-CHANGING. I was $70K+ in debt and did not think it would ever be possible to get out of debt. I didn't even know where to start. Now I'm down to $20K and should be debt-free by next year! Thank you!

Andrea from Michigan

Sign up with your email to take the first step toward taking control of your money once and for all.

Jump into the video lessons, set up your first budget, and see how awesome Ramsey+ is.

Sleep better knowing you’re doing the right thing for yourself and your money.

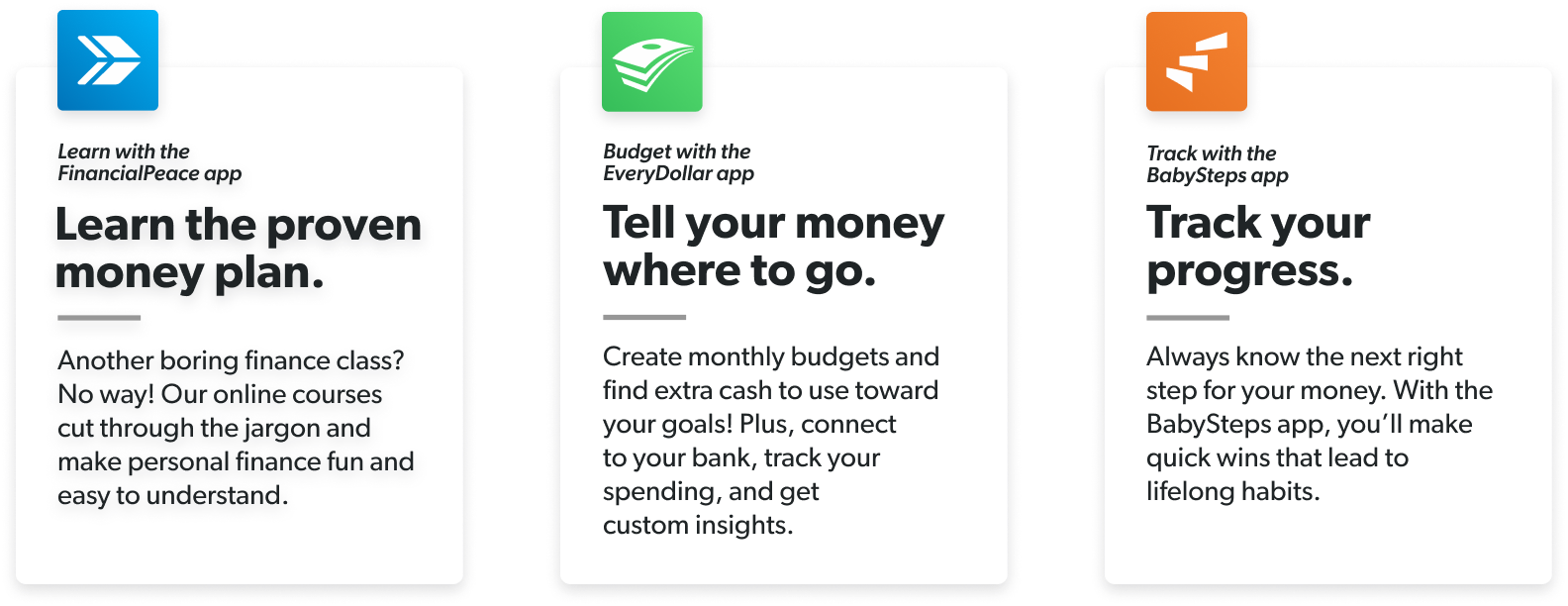

Ramsey+ is an all-access membership to our best money tools, apps and content. With Ramsey+ you’ll discover how to take complete control of your money—and get the tools you need to make it happen. Your membership includes access to our online courses, including Financial Peace University, the premium version of EveryDollar, the BabySteps app, PLUS so much more.

Ramsey+ is for people who need help or want to do better with money! It has the content, tools and resources you need to reach your money goals faster. Whether you’re trying to get out of debt or save for retirement, Ramsey+ is here for the entire journey.

Ramsey+ includes three different apps: FinancialPeace, EveryDollar and BabySteps. But you also get tons of other great features, like virtual groups with Financial Peace University, coaching resources, tailored content and budget reporting.

A Ramsey+ membership gives you access to all three amazing apps. It’s like getting guac, queso and salsa for the price of one. We don’t do individual app subscriptions.

You bet! Visit our store to purchase. When you check out, select “Send as a gift” and fill in the recipient’s information at the bottom of the form. After you purchase, they will immediately receive an email with instructions on how to set up their account.

Yes! Just use the same username and password to log in to as many devices as you need.

Learning to handle money the right way doesn't stop after the nine lessons in FPU—it's a lifelong journey. There are tons of tools, new courses, deep dives and other perks that come with a Ramsey+ membership—like free federal tax filing, audiobooks and livestreams.

We took the Financial Peace Membership and made it a Ramsey+ membership. We added more content and put all of our bestselling tools together in one all-access package.

Absolutely! Paying off debt is only the beginning. Handling money the right way is a lifelong process. That's why FPU teaches you all about money—from paying off debt to insurance and investing to buying real estate. And the best way to build up those financial muscles at any step is budgeting. EveryDollar makes it easy to set up your monthly budget, track your expenses, and head toward your goals even faster.

We know it is. Following the 7 Baby Steps, the average household finds $332 after their first month of budgeting. In the first 90 days, the average household pays off $5,300 in debt and puts $2,700 into savings. And that’s just in the first three months! Imagine what you can do after that.